Guide to Recurring Payments: Online Payment Processing

Subscription Management Software uses online payment methods like ACH payments, Debit cards, Credit Cards, Cryptocurrency, Mobile Payments, and other alternative payment methods to process recurring payments faster, safer, and directly to the merchant’s account. The recurring billing system integrates payment processing providers to ensure security as they encrypt the transaction data between the issuing and acquiring bank and facilitates secure payment processing without the risks of online payment frauds.

Learning about online payment processing for recurring payments encompasses the understanding of the workflow of payment processing in recurring billing and payment system and online payment processing ecosystem.

Let’s begin:

What is Payment Processing for Recurring Billing?

Recurring Billing also knows as Subscription Billing or Subscription Management is the process of billing a customer after every interval for a specific length of the term. There are four core essentials of the recurring billing:

- Customer’s Bank

- Merchant’s Bank

- Payment Gateway

- Recurring Billing System

The recurring billing system works on top of the payment gateway to process the recurring payments. It automates the recurring payment processing and collection by connecting the recurring billing system with the issuing bank, acquiring bank, and payment gateway for hassle-free payment processing every time the billing and payment cycle hits.

Understanding the Online Payment Processing Ecosystem

It looks so simple that the customer sends the money to the merchant’s account and it is received by the merchant within a few seconds. However, this involves the whole ecosystem that manages the secure and fast payment processing.

Online payments are fraud-prone. To prevent the risks associated with the online payments, the APIs responsible for managing different billing logics, like handling checkout pages, sending payment notifications, payment processing providers, and more, coordinate and connect multiple elements in the ecosystem. These APIs are:

- Payment Request API

- Payment Handling API

- Payment Method Identifiers

- Payment Method Manifest

To ensure the security of the online transaction, the following elements are involved:

- Payment Gateways—they transmit transaction details to the processors. Also, they serve as the additional layer of a blank account to the merchant’s account to receive credit card payments.

- Payment Processors—they execute the transactions by transmitting the data between the customers, merchant, issuing bank, and acquiring bank.

- Hybrids or Payment Service Providers—as the name suggests, some payment gateway serve as payment processors as well. This is why they are called Payment Service Providers or PSPs. The most popular examples of PSPs are PayPal and Stripe.

Why Payment Service Providers Are Important?

Credit, Debit, or other payment alternatives—the Payment Service Providers, or commonly called Payment Gateways, are used to process all sorts of online payments.

Online transactions demand security and reliability without any complications for faster and safe payment processing. This is where the Payment Gateways serves the purpose. Sitting in the mid of the three core elements of the recurring billing and payment processing, payment gateways provide the following assurances for automated online recurring payment processing:

The most important function of the payment gateway is to lessen the risks of online payment frauds. The risks associated with the severity of the credit card frauds are prevalent in the subscription business.

Payment gateways encrypt the data between the user and the merchant for safe payment processing. It sends an authorization request to the credit card company, bank, or any other financial institution to process transactions. Upon authorization, it allows the user’s browser and the payment gateway interface to process payments.

AI-enabled payment processing providers are also able to detect geo-location, orders screening, tax calculation, and more.

How Do Payment Gateways for Recurring Payments Work?

The basic purpose of the payment gateway is to ensure faster, safer, and seamless online payments.

The payment gateways are not responsible to transfer the fund, instead, they approve the funds transference to the merchant’s accounts in a secure way from the customer’s account.

Payment gateways are PCI-Compliant to identify and mitigate the risks of online payment frauds.

Following is a step-by-step description of how payment gateways facilitate the recurring payments:

- The client integrates and configures the payment gateway in the subscription management software.

- A subscription with the assigned payment method has been created. ACH Payments or Credit Card—the customer provides the details of the payment method chosen.

- Whenever the billing cycle hits, the merchant from the platform of the recurring billing software sends the transaction details to the payment processor of the merchant’s account.

- The details then are sent to the affiliated card that manages the approval or denial of the transaction request.

- When the transaction request gets approved by the issuing bank, the processor sends the approval to the payment gateway.

- After transaction approval, the payment gateway allows the platform to process the payments.

- Once the transaction is completed by the merchant, the status of ‘Clearing Transaction’ activates, and the issuing bank permits the funds settlement with the merchant’s account after deducting the transaction fee.

How to Select the Best Payment Gateway for Recurring Payments?

Selecting the best payment processing provider or payment gateway is a crucial deal. The integration of a reliable payment gateway ensures client or customer’s trust in the secure transactions within the healthy and safe online payment processing ecosystem. Otherwise, the customer can annul the deal, without making any sales, despite placing the orders.

In the recurring billing business, configuring the right payment gateway, not only, strengthens the probabilities of long-term customer commitment, it also ensures a seamless online, safe, and faster collection of revenue.

Not all payment gateways support automated recurring payment processing. Choosing appropriate payment processing providers may a subscription business owner to undergo some research before selecting a payment gateway integration in the subscription management system. Some of the must-consider factors include:

- Transition Fee

- Service Agreement Requirements

- Automated Recurring Payment Support

- Multi-Currency Support

- Multiple Payment Method Support

- Simple and Secure Checkout

- Easy Integration

- Merchant Account

- Geo-location Support

- Terms & Conditions for Physical or Digital Goods

- 24/7/365 Customer and Technical Support

The Best Online Payment Services Providers for Recurring Billing and Payments

Based on their utility, resources, and transactional security requirements, Recurring Billing Businesses choose the payment gateways or hybrid online payment processing providers to integrate the one that best serves their interests. Some of the most popular and widely used online payment processing providers are:

| PayPal | SecurePay | Blue Snap |

| Stripe | First Data Corporation | PaySimple |

| Authorize.net | Payline Data | PaySafe |

| GoCardless | Square | Card Connect |

| Braintree | AliPay | WePay |

| Adyen | Amazon Payments | Table |

SubscriptionFlow and Best Payment Gateways Integrations for Recurring Payments

SubscriptionFlow allows the clients to set up their preferred gateways in a few easy steps.

Here is a quick guide for the clients to configure settings for any payment gateway using the examples of the top most popular payment gateways integrated with the SubscriptionFlow:

- PayPal

- Stripe

- Net

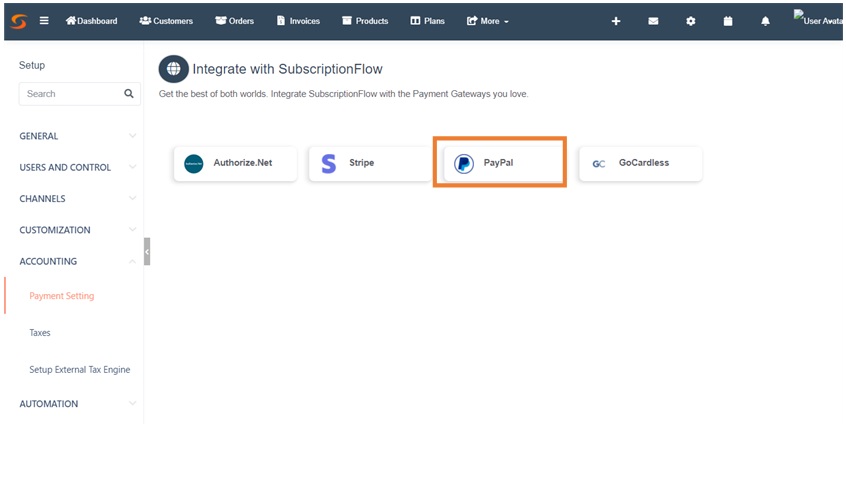

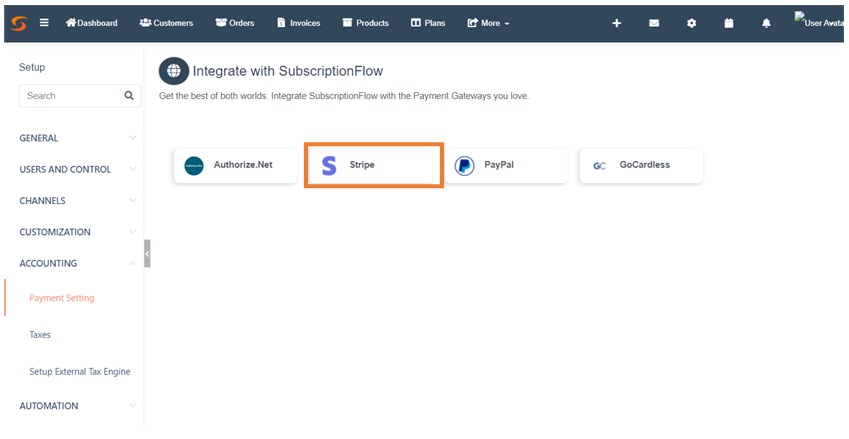

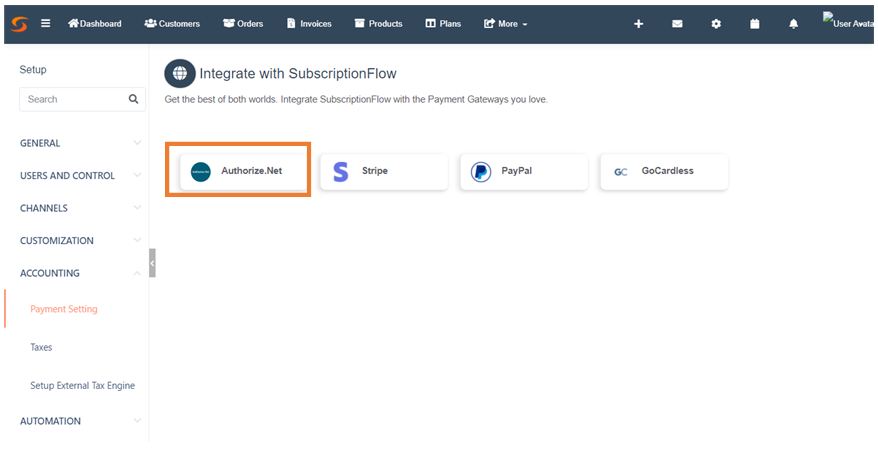

Login to the SubscriptionFlow dashboard, click on the settings icon, and choose the ‘Payment Settings’ under the section of Accounting. Select the payment gateway to be configured and follow the step-by-step process to process online recurring payments, instantly and safely.

SubscriptionFlow and PayPal Payment Gateway for Recurring Payments

- Select ‘PayPal’ on the Payment Settings Page.

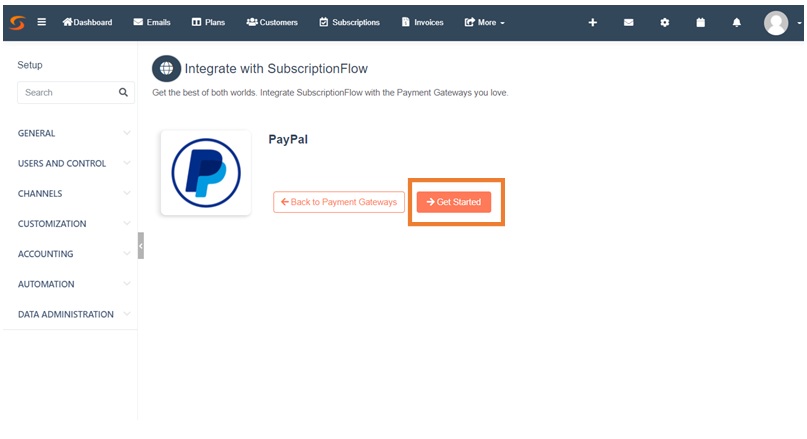

- Access the PayPal page for configuration settings, click on the ‘Get Started’ tab.

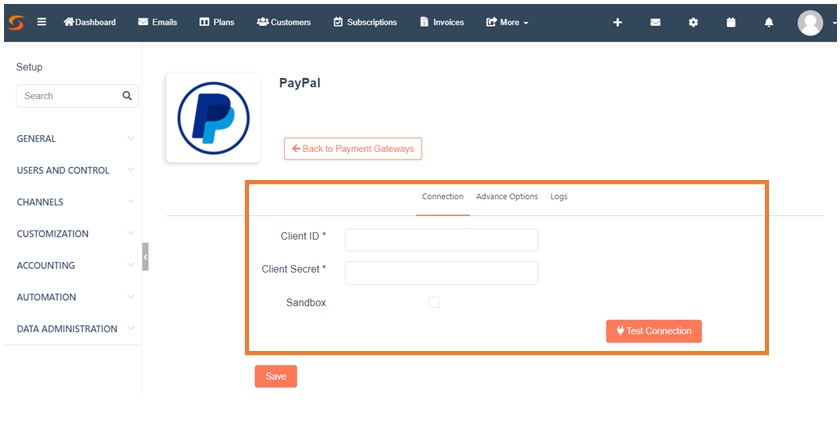

- A new page with the fields for login credentials will appear.

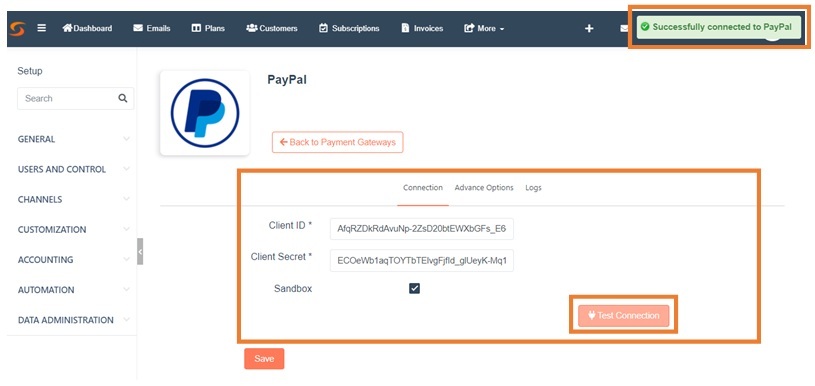

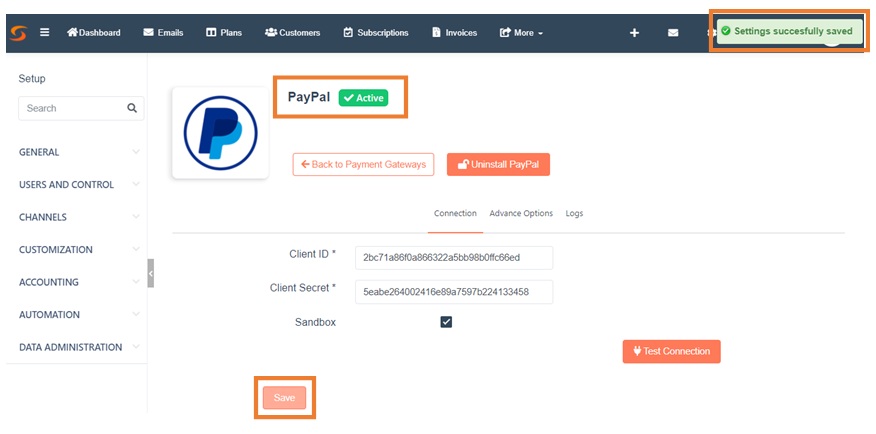

- To configure the PayPal, enter the login credentials under the connection tab. Check the Sandbox and click on the ‘Test Connection’. This will connect the payment gateway.

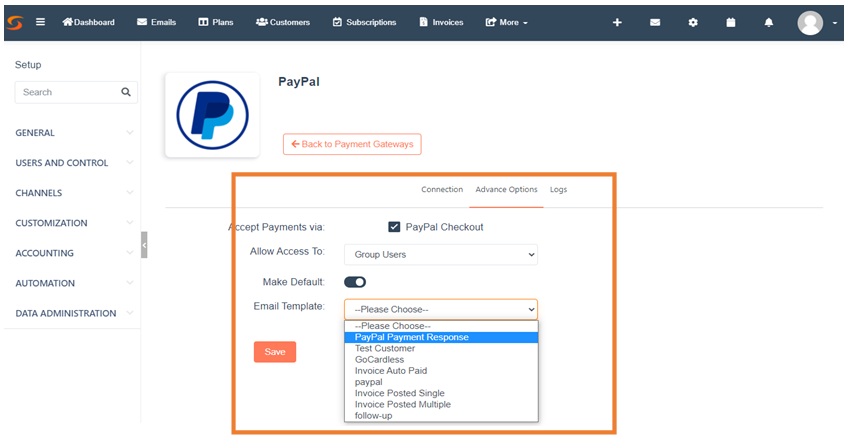

- Under the ‘Advance Options’ tab, tick-over the PayPal checkout. Select the allowed users from the drop-down menu to access and manage the payment gateway settings.

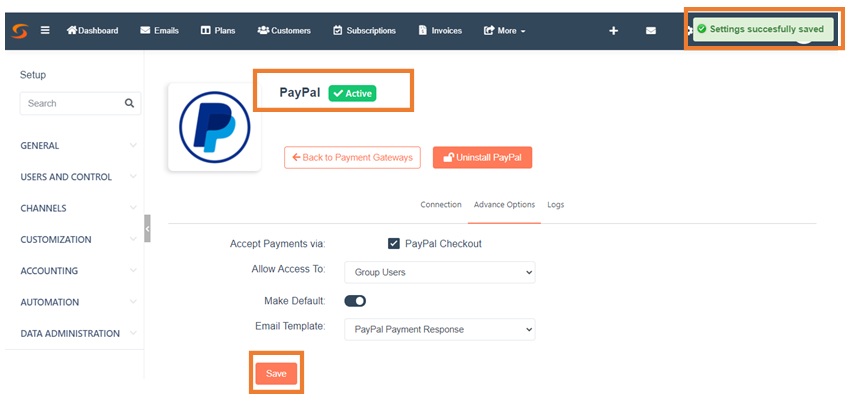

- Select the pre-made response email template with the payments from the drop-down menu. Hit the ‘Save’ button.

- This will activate the gateway for the subscription account.

- Go back to the Connection tab and save the settings. Clicking on the ‘Save’ tab configures the settings successfully.

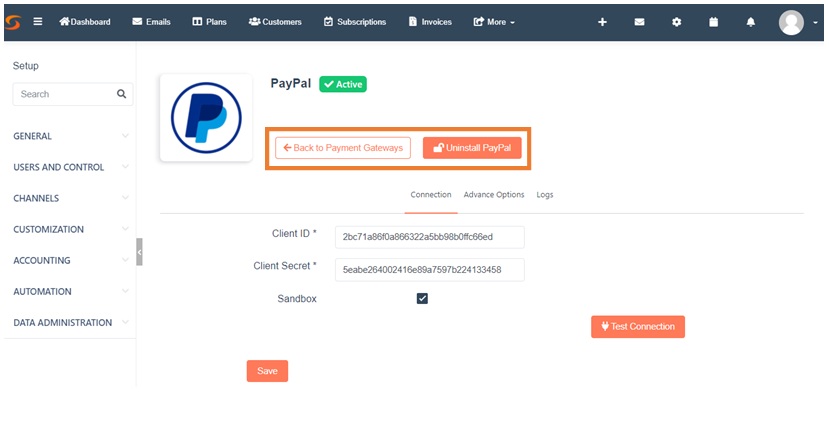

- To configure another gateway, click on the ‘Back to Payment Gateway’. And, to uninstall the recently configured payment gateway, click on the ‘Uninstall’ Tab.

SubscriptionFlow and Stripe Payment Gateway for Recurring Payments

- Select ‘Stripe’ on the Payment Settings Page.

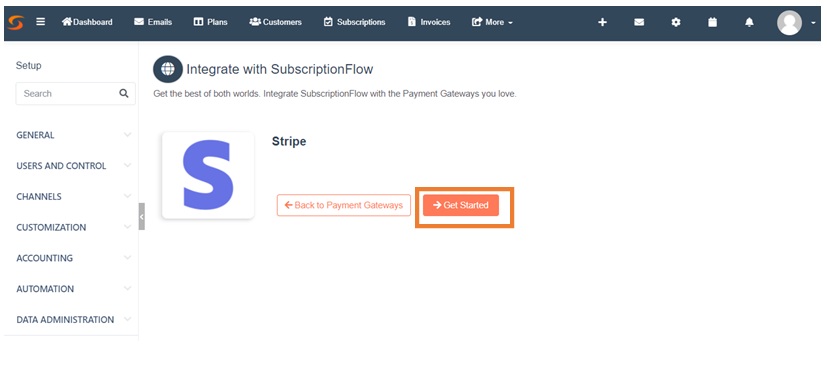

- Access the Stripe page for configuration settings, click on the ‘Get Started’ tab.

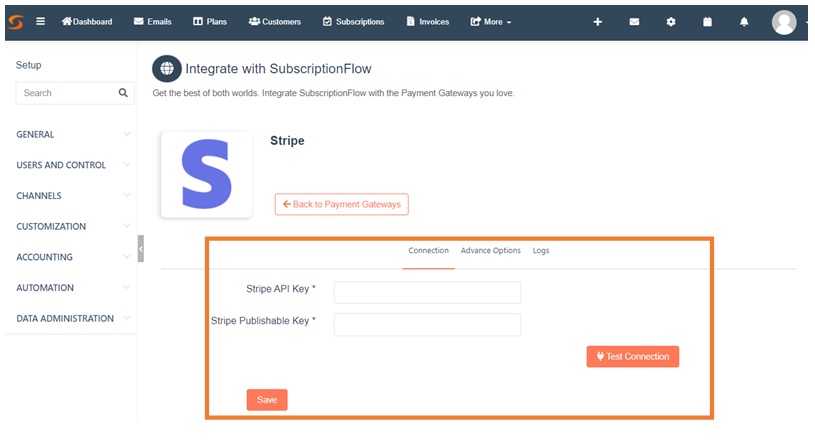

- A new page with the fields for login credentials will appear.

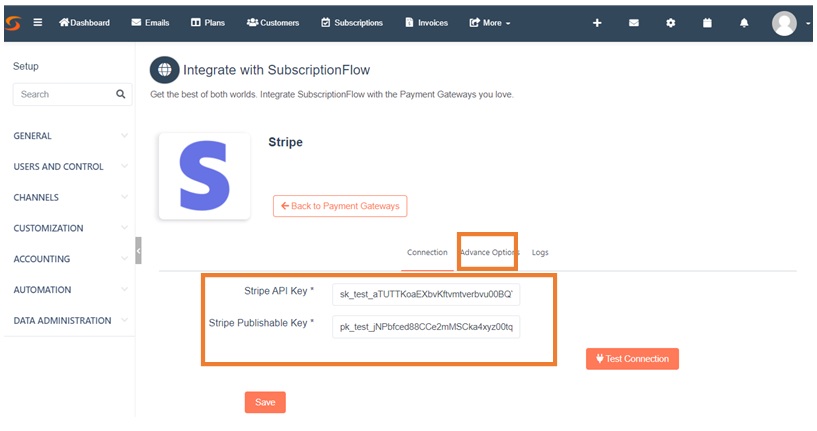

- To configure the Stripe, enter the login credentials under the connection tab.

- Under the ‘Advance Options’ tab, check the customer payment methods and select the allowed users from the drop-down menu to access and manage the payment gateway settings. Hit the ‘Save’ button.

- Go back to the ‘Connection’ tab and hit the ‘Test Connection’ button. It will connect the SubscriptionFlow platform to the payment gateway.

- Clicking on the ‘Save’ tab configure the settings successfully and activate the payment gateway.

- To configure another gateway, click on the ‘Back to Payment Gateway’. And, to remove the recently configured Stripe, click on the ‘Uninstall Stripe’ Tab.

SubscriptionFlow and Authorize.Net Payment Gateway for Recurring Payments

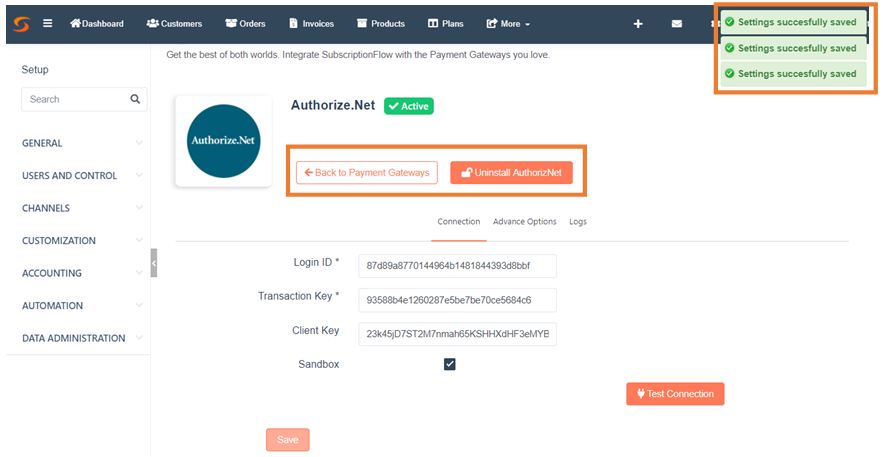

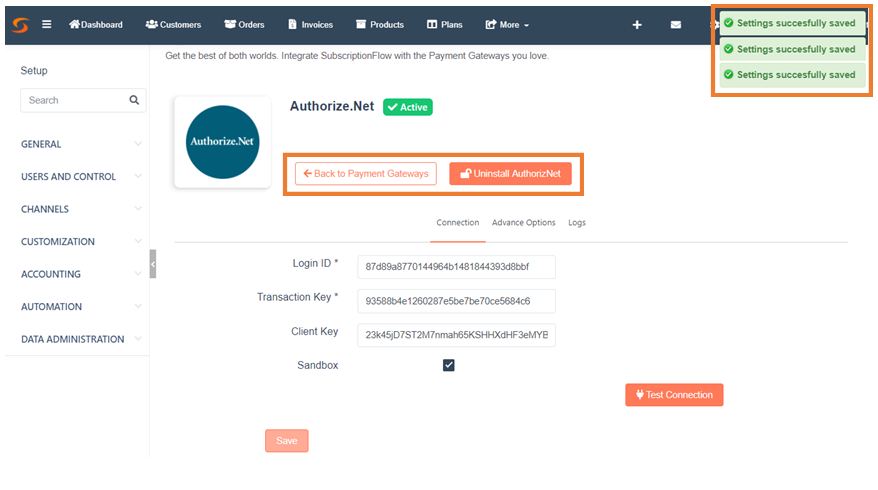

- Select ‘Authorize.Net’ on the Payment Settings Page.

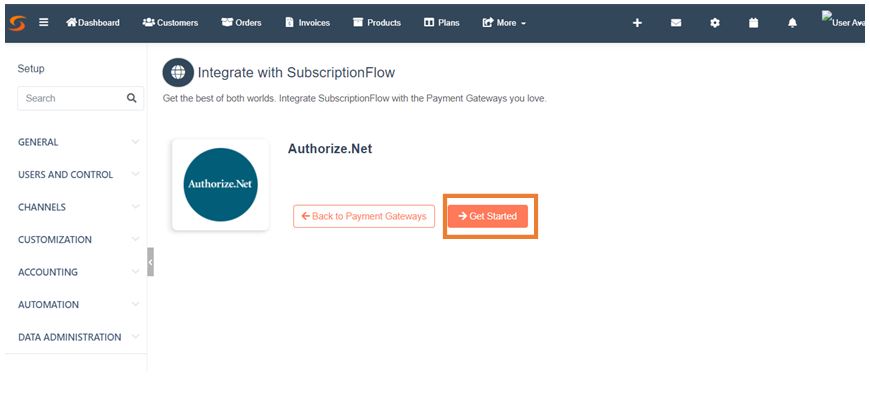

- Access the Net page for configuration settings, click on the ‘Get Started’ tab.

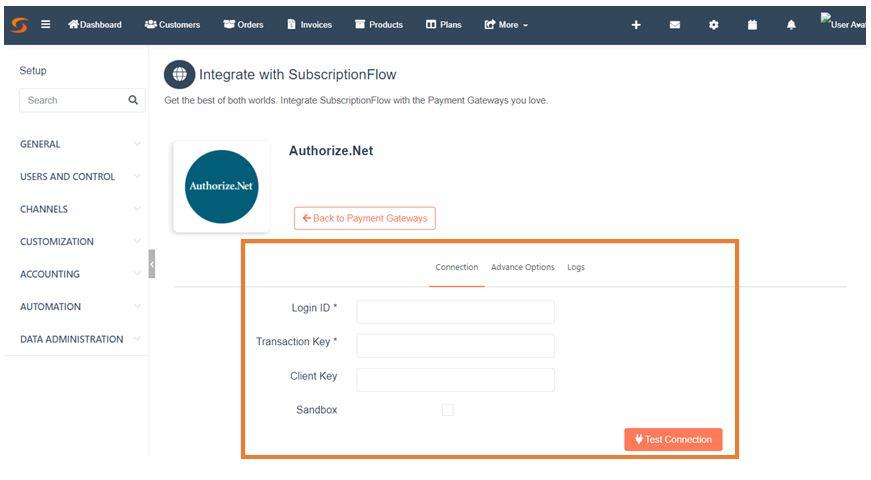

- A new page with the fields for login credentials will appear.

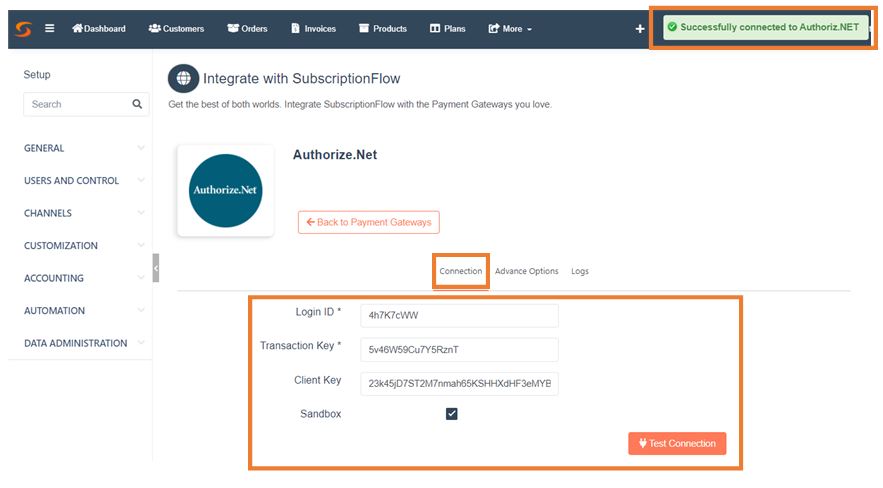

- To configure the Authorize.Net, enter the login credentials under the connection tab, check the SandBox, and click on the ‘Test Connection’.

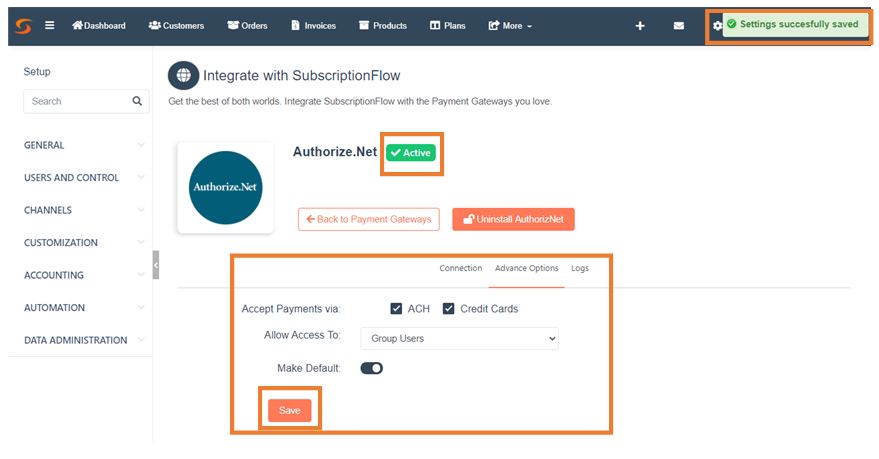

- Under the ‘Advance Options’ tab, check the customer payment methods and select the allowed users from the drop-down menu to access and manage the payment gateway settings. Hit the ‘Save’ button. Your Payment Gateway is not connected and activated.

- Go back to the ‘Connection’ tab and save the setting to configure the SubscriptionFlow platform to the payment gateway.

- To configure another gateway, click on the ‘Back to Payment Gateway’. And, to uninstall the recently configured Authorize.Net payment gateway, click on the ‘Uninstall’ Tab.