What is MRR? Importance for Measuring Recurring Revenue

Metrics—the saviors of the sales, accounting, and finance teams and managers in a board room. Sales is a tough job, but reporting sales is tougher than sales themselves. You cannot bring along the account details, bill books, finance, and audit reports, accounting spreadsheets, and other, but what you can do is to explain the ongoing sales numbers and the reasons of revenue growth or decline quickly with the faster, easier, and simpler metrics, like MRR—Monthly Recurring Revenue.

MRR is mostly used by SaaS and subscription billing businesses to measure, monitor, and manage their recurring revenue stream. Momentum, Customer Lifecycle Value, or Cohort—it is the only metric without which subscription performance reporting cannot be completed.

Let’s see what, exactly, the MRR is and how it helps analyze the monthly revenue growth, the impact of recurring payments in the revenue stream, monthly sign-up rate, monthly retention rate, and churn rate.

What is Monthly Recurring Revenue?

MRR or Monthly Recurring Revenue refers to the effective monthly revenue collected from all the recurring billing accounts or subscriptions. It also predicts the recurring revenue for the coming or next months and hence instantly identifies the leakages or the growth in the recurring revenue.

MRR includes revenue collected every month after recurring items in the cart, such as;

- Coupons

- Discounts

- Recurring Add-ons

- Any recurring ad-hoc charges

What it does not include are;

- Tax amount

- Setup fee.

- Non-recurring add-ons.

- Credit adjustments.

- Any non-recurring Ad-hoc charges that are not part of the recurring revenue stream.

Understanding MRR—The Recurring Revenue Health Indicator

MRR plays a significant role in monitoring, measuring, and reporting recurring revenue in a given month. It is a simple metric that does not involve too many complexities, but some elements need to be understood to better learn how recurring revenue management and intelligent business decisions for revenue growth.

The other business models can easily identify when and how much they have made money with upfront or one-time billing in any month. Comparing the monthly recurring revenue can unearth the best month with the most sales and revenue growth.

However, in the subscription business model, it is not as simple as it seems in other business models.

Here the sustainability and revenue growth is determined by the consistency in the recurring payments you receive each month. The recurring revenue collected a month also projects or forecasts the revenue for the next month.

This is why the businesses revolved around subscriptions or subscription alike revenue model, it is an indicator that only depicts the health but is reliable in guiding profit-oriented business decisions.

What are some types of MRR?

There are several kinds of MRR that assist in defining the trends within the monthly recurring revenue. The various kinds of MRR are:

New MRR

MRR from new customers who have subscribed to a new product or service recently, marking the growth within the customer base.

Expansion MRR

MRR from customers who have upsold their subscription or purchased add-on services or features, marking the rise in revenue per user.

Churn MRR

MRR was lost because of cancelled subscriptions by the customers, marking the loss caused by customer cancellations during that month.

Reactivation MRR

MRR from subscribers who previously canceled their subscription but have since returned, which is the regained revenue because of customer retention.

Contraction MRR

Lost MRR because of existing subscribers downgrading their subscription or deleting services or features, which is the loss of revenue per customer.

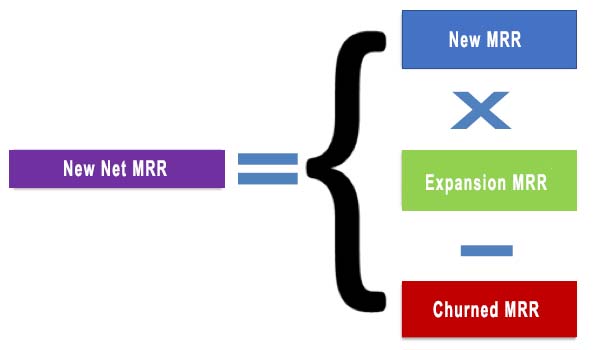

Net New MRR

The total of New MRR and Expansion MRR, subtracted by the Churn MRR and Contraction MRR, is the net growth in monthly recurring revenue.

How to Calculate the MRR?

MRR is the measurement of the total predictable amount a company expects every month that also reveals the month-to-month difference in the recurring revenue. There are no hard and fast rules to measure the MRR.

The different types of MRR can be calculated by:

- Average Revenue Per User Method

The simple formula to calculate the Average MRR is

Here the Average Revenue Per Account or ARPA is a metric that determines how much each customer is paying every month on an average. Then, the obtained average figure is multiplied by the total number of customers.

Here, both of the elements are variable and influence the other element.

When APCA increases, it automatically raises the figure of MRR, and, if it decreases, the MRR shows a negative trend.

Likewise, when there are more customers, it shows more MRR, whereas, when there is churn, this figure reduces, too.

- Customer-By-Customer Method

It is a widely used and easier method to figure out the recurring revenue in the month. It is simply the sum of the recurring payments received from all the subscribers in a month.

MRR = Recurring Payment 1 + Recurring Payment 2 + Recurring Payment 3 + Recurring Payment 4 + ….

New Net MRR is the subset of the Customer-By-Customer Method. It is the aggregate of the new revenue gathered in a month from the fresh sources. It can be obtained by

MRR is not GAAP Revenue Recognition

MRR and GAAP Revenue Recognition are not the same. GAAP Revenue recognition is the principle accounting obligation that is required to be reported. On the other hand, MRR is a normalized and predictable measurement of recurring revenue in a month.

GAAP revenue recognition is a complex and a systematic way to measure the accurate recurring revenue and identify them into exact categories as:

- Recognized Revenue

- Unrecognized Revenue

- Deferred Revenue

GAAP Revenue Recognition has more fluctuation in numbers, called noise or jittering to obtain exact figures. However, MRR shows the average and constant recurring figures to obtain each month’s recurring revenue.

What is the significance of MRR calculation for a business?

MRR is a critical revenue-measuring metric that is important for the SaaS ecosystem. Based on the contract, the MRR can exclude one-time fees, but for monthly-based service businesses, they can be included. MRR enables SaaS businesses to ensure their health and well-being, thereby assisting in gauging the financial side of the business.

MRR assists SaaS companies in understanding every facet of their service operations that pertains to money. Information from MRR can assist SaaS companies in locating areas requiring additional resources to augment revenues and decrease churn.

MRR is an important metric for any subscription business. Businesses need to break up various segments of MRR in order to have a real picture of their figures. MRR is an operating and board-level metric.

Also, MRR growth is an important metric within the SaaS community. The calculation of this metric becomes very complex when your customer base and operations are large.

What are some best practices to increase MRR?

In order to increase MRR, here are some tips and tricks to help you enhance your footprint in the modern-day SaaS industry:

Price Adjustment

It usually makes sense to keep an eye on the rate structures of your competitors in your industry so that you don’t overprice or underprice your service. After all, if you can increase your price without going above your competitors, you should be able to increase revenues without taking on significant churn. On the other hand, if potential customers perceive that you are too expensive, they will avoid you.

Meanwhile, you need to rethink your whole pricing structure and implement tiered service or usage tiers. If you bill on a per-account basis, moving to a user-based metric may be more appropriate, especially if your customers differ considerably in terms of size or consumption of services.

Prioritize Customer Satisfaction

Keeping a check on how well your team is offering the services and responding to customer queries is important. If you have a healthy figure of thriving subscribers, it is suggested to regularly survey them and know if they are satisfied with your services.

Contacting those who are seemingly delaying payments or not in time for payments must also be a concern, as you must know why they have changed patterns. In case of any challenges on the subscriber’s part, you must devise strategies to address the challenges and keep your customers at the heart of your services. Addressing their concerns is better than losing them in the long run.

Don’t ignore analytics

Routine reports are necessary for monitoring the latest trends and overall business progress. When you are able to break down your MRR, you’ll be far better placed to identify what is and isn’t working. A declining MRR, after all, may quite easily be a result of poor sales or high churn.

Following these core performance indicators (KPIs) in greater detail can also enable you to measure the effectiveness of the actions that you have undertaken. Did the recent marketing campaign boost your new MRR? Did customer satisfaction rise and churned MRR fall when you added that chatbot to your website?

Increase Sales

Increasing your sales force is crucial to improving business MRR. Generation of bigger revenues involves incentivizing current customers. You must perform A/B testing to check which messages or strategies are best suited to potential customers. Are your potential buyers more interested in some features than others?

Are they more inclined towards social media marketing or a customized email approach to communication? The more you know about your subscribers, the easier it will be to achieve an expanding customer base.

Double-check for non-monthly billing periods.

It’s typical that quarterly, semi-annual, or yearly contracts are reflected as a whole payment in one month. If the customer pays for their entire membership in advance, that shouldn’t be counted for one month but rather split by the number of months the subscription is paid up for to reflect an actual correct figure.

Always count coupons and discounts.

Omitting the discounted rates that subscribers are given is also a deceptive mistake. Even with a small discount, when multiplied over several hundreds or thousands of subscribers, that can make a big difference on your revenue report. If you don’t account for that difference, your MRR will be artificially high.

Measuring Monthly Recurring Revenue in SubscriptionFlow

SubscriptionFlow is a fully automated recurring billing and payment processing platform that offers AI-augmented automation of MRR calculation that helps in optimize pricing and subscription plans, depicts subscription health, customer lifecycle health, guides in creating coupons, discounts, vouchers, and other add-ons.

As soon as you log in, your MRR and ARR are visible on the dashboard. The data visualization of the recurring payments during a subscription cycle will help you to monitor, measure, and, intelligently, manage the different types of MRR towards achieving the higher target of ‘Negative Churn’ and optimum recurring revenue collection.

Talk to our experts for more insights and impacts of MRR over the growth of the subscription business and how SubscriptionFlow is the best solution to manage the 360-degree subscription management—recurring billing, payments, and revenue—efficiently.