What is MRR? Importance for Measuring Recurring Revenue

Metrics—the saviors of the sales, accounting, and finance teams and managers in a board room. Sales is a tough job, but reporting sales is tougher than sales themselves. You cannot bring along the account details, bill books, finance, and audit reports, accounting spreadsheets, and other, but what you can do is to explain the ongoing sales numbers and the reasons of revenue growth or decline quickly with the faster, easier, and simpler metrics, like MRR—Monthly Recurring Revenue.

MRR is mostly used by SaaS and subscription billing businesses to measure, monitor, and manage their recurring revenue stream. Momentum, Customer Lifecycle Value, or Cohort—it is the only metric without which subscription performance reporting cannot be completed.

Let’s see what, exactly, the MRR is and how it helps analyze the monthly revenue growth, the impact of recurring payments in the revenue stream, monthly sign-up rate, monthly retention rate, and churn rate.

Also Read: Three Core Metrics to Measure Subscription Business Growth

What is Monthly Recurring Revenue?

MRR or Monthly Recurring Revenue refers to the effective monthly revenue collected from all the recurring billing accounts or subscriptions. It also predicts the recurring revenue for the coming or next months and hence instantly identifies the leakages or the growth in the recurring revenue.

MRR includes revenue collected every month after recurring items in the cart, such as;

- Coupons

- Discounts

- Recurring Add-ons

- Any recurring ad-hoc charges

What it does not include are;

- Tax amount

- Setup fee.

- Non-recurring add-ons.

- Credit adjustments.

- Any non-recurring Ad-hoc charges that are not part of the recurring revenue stream.

Understanding MRR—The Recurring Revenue Health Indicator

MRR plays a significant role in monitoring, measuring, and reporting recurring revenue in a given month. It is a simple metric that does not involve too many complexities, but some elements need to be understood to better learn how recurring revenue management and intelligent business decisions for revenue growth.

The other business models can easily identify when and how much they have made money with upfront or one-time billing in any month. Comparing the monthly recurring revenue can unearth the best month with the most sales and revenue growth.

However, in the subscription business model, it is not as simple as it seems in other business models.

Here the sustainability and revenue growth is determined by the consistency in the recurring payments you receive each month. The recurring revenue collected a month also projects or forecasts the revenue for the next month.

This is why the businesses revolved around subscriptions or subscription alike revenue model, it is an indicator that only depicts the health but is reliable in guiding profit-oriented business decisions.

Different Types of MRR

The different types of MRR help to identify the trends in the monthly recurring revenue. MRR can be categorized into the following six types:

- New MRR—it is the addition of recurring payment in a recurring revenue stream in a month.

- Expansion MRR—it is an additional recurring payment along with New MRR when the subscriber upgrades a subscription plan.

- Contraction MRR—it is the reduction in the recurring payment in a New MRR when the subscriber downgrades a subscription plan.

- Reactivation MRR—it is another form of New MRR when the subscriber re-activates the subscription plan and continue to contribute to the recurring revenue.

- Churned MRR—it is the reduction in the monthly recurring revenue when a subscriber unsubscribes or pause the subscription plan without completing the term.

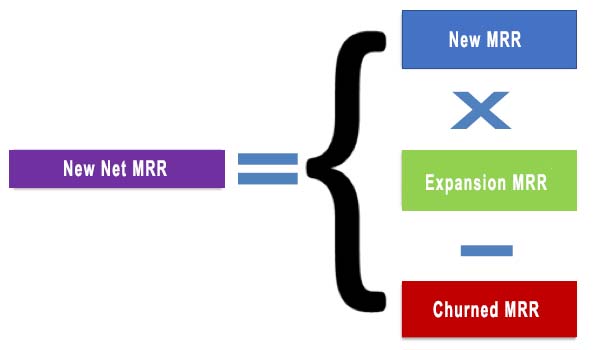

- New Net MRR—it is the sum of New MRR and Expansion MRR after deducting the Churned MRR.

How to Calculate the MRR?

MRR is the measurement of the total predictable amount a company expects every month that also reveals the month-to-month difference in the recurring revenue. There are no hard and fast rules to measure the MRR.

The different types of MRR can be calculated by:

-

Average Revenue Per User Method

The simple formula to calculate the Average MRR is

Here the Average Revenue Per Account or ARPA is a metric that determines how much each customer is paying every month on an average. Then, the obtained average figure is multiplied by the total number of customers.

Here, both of the elements are variable and influence the other element.

When APCA increases, it automatically raises the figure of MRR, and, if it decreases, the MRR shows a negative trend.

Likewise, when there are more customers, it shows more MRR, whereas, when there is churn, this figure reduces, too.

-

Customer-By-Customer Method

It is a widely used and easier method to figure out the recurring revenue in the month. It is simply the sum of the recurring payments received from all the subscribers in a month.

MRR = Recurring Payment 1 + Recurring Payment 2 + Recurring Payment 3 + Recurring Payment 4 + ….

New Net MRR is the subset of the Customer-By-Customer Method. It is the aggregate of the new revenue gathered in a month from the fresh sources. It can be obtained by

MRR is not GAAP Revenue Recognition

MRR and GAAP Revenue Recognition are not the same. GAAP Revenue recognition is the principle accounting obligation that is required to be reported. On the other hand, MRR is a normalized and predictable measurement of recurring revenue in a month.

GAAP revenue recognition is a complex and a systematic way to measure the accurate recurring revenue and identify them into exact categories as:

- Recognized Revenue

- Unrecognized Revenue

- Deferred Revenue

GAAP Revenue Recognition has more fluctuation in numbers, called noise or jittering to obtain exact figures. However, MRR shows the average and constant recurring figures to obtain each month’s recurring revenue.

Also Read: SubscriptionFlow Considers Implementing ASC 606 in their New Version

Why New MRR and Expansion MRR Are Important and How to Optimize these Metrics?

Focusing on earning New MRR and Expansion MRR helps subscription businesses to grow. The inclusion of new customers into the recurring revenue stream depicts the acquisition of customers, whereas the growth of Expansion MRR depicts customer retention with more opportunities for upsells, cross-sells, or re-sells.

Expansion MRR also holds great significance because its increasing numbers help development, marketing, and sales departments to identify the customer needs and attract more customers for upgrades or reselling.

Together, they neutralize the effect of the churn rate and bring in the ‘negative churn’ to upscale the revenue growth and business expansion.

Using some of the below-mentioned tips and tricks will help subscription merchants to optimize their MRR growth just by concentrating on these two main categories of MRR and converge the leads to these two concentrated points:

-

Optimal Pricing

Optimal Pricing doesn’t mean charging less; it is the way to optimize pricing, smartly the way their product worth in helping customers to save their time, money, and other resources.

Acquiring new customers requires minimum friction, including hurdles in sales, pricing, payment methods, etc. This is why, it is recommended for the collection of new MRR to remove the frictions as much as you can, and for expansion MRR, charge high.

The other pricing technique is to optimize pricing by offering multiple pricing plans. So, a customer can take the plan and pricing as per their needs and budget. Some of the best ways to earn more revenue are offering the following usage-based pricing types:

- Metered Pricing

- Pay-per-User Pricing

- Pay-per-Feature Pricing

- Combo Pricing

-

Avoid Free Plans and Fremiums

Free Plans and Fremiums are killers of healthy revenue streams. To acquire new clients or new MRR, Free Plans and Fremium works to some extent, but they are not good for Expanded MRR.

Expanded MRR growth requires combo pricing to draw more customers towards upsells or cross-sells to earn more profit.

Measuring Monthly Recurring Revenue in SubscriptionFlow

SubscriptionFlow is a fully automated recurring billing and payment processing platform that offers AI-augmented automation of MRR calculation that helps in optimize pricing and subscription plans, depicts subscription health, customer lifecycle health, guides in creating coupons, discounts, vouchers, and other add-ons.

As soon as you log in, your MRR and ARR are visible on the dashboard. The data visualization of the recurring payments during a subscription cycle will help you to monitor, measure, and, intelligently, manage the different types of MRR towards achieving the higher target of ‘Negative Churn’ and optimum recurring revenue collection.

Talk to our experts for more insights and impacts of MRR over the growth of the subscription business and how SubscriptionFlow is the best solution to manage the 360-degree subscription management—recurring billing, payments, and revenue—efficiently.