Myths about Payment Gateway Fees

Cashless transactions enabled by safe, quick, and versatile payment gateways are the lifeblood of subscription businesses, as well as, any enterprise that want to cash in (pun intended) on the ever-growing pool of consumers that want to pay online. Yet, plenty of myths about payment gateways sabotage their true potential to help generate revenue for your business!

The E-Commerce industry is growing at a compound annual growth rate (CAGR) of 14.7%, which means seamless, secure and reliable systems are already in place to enable online transactions, why then do so many still remain unconvinced of their importance and the convenience they offer!

A lack of awareness around how these payment gateways actually operate might well be the cause. So, let’s take a look at how cashless payments really work, bust some myths about payment gateway fees and also shed some light on what features to look out for when selecting the best payment gateway for your business!

What Does a Payment Gateway Do?

A payment gateway is simply a SaaS product that acts as a liaison between your point-of-sale (POS) system and payment processor, securely relaying sensitive information between the two! The gateway simply captures, encrypts and passes on sensitive customer data to the processing company and for this value-added service they charge a fee.

Sounds reasonable enough, right?

A reliable subscription management system also provide integrations with top payment gateway platforms as add-ons that allow your business to manage subscriptions, automated recurring billing and customize branded checkout pages all in one convenient place!

A payment gateway can handle the following types of transactions:

1. Authorization: A transaction that checks if a customer’s account has enough funds for a successful payment

2. Capture: The actual transaction of an authorized payment resulting in funds being transferred into a merchant’s account

3. Sale: The combination of a successful authorization and capture transaction.

4. Refund: The result of a canceled order for which a merchant issues a refund to return any money charged to the customer’s bank account as a result of a sale transaction

5. Void: Similar to a refund transaction but refers to transaction where funds were not successfully captured

Now that we know the kind of information a payment gateway is securely channeling, let’s take a look at the workflow of the payment process to demystify what’s going on at the backend of your check out page!

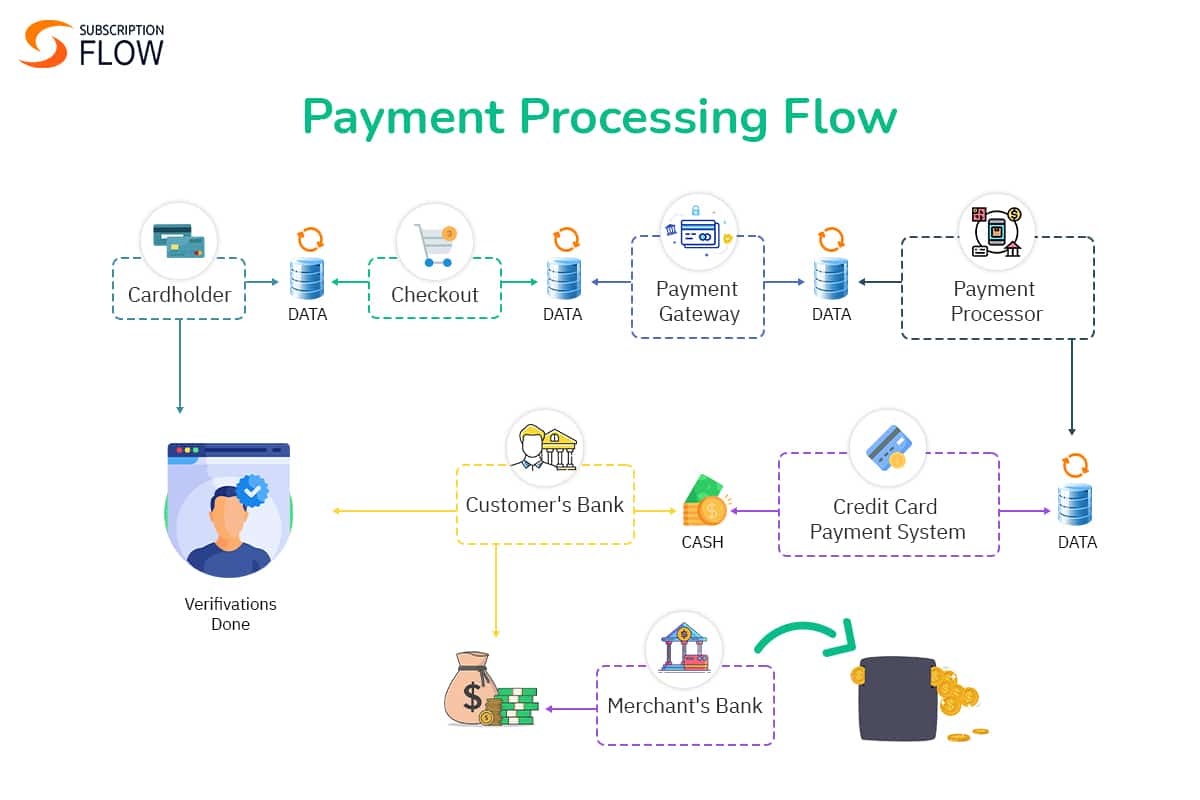

Payment Processing Flow

1. It all starts with the customer pressing a “Purchase” button after inputting cardholder data into a checkout page. The data is encrypted and sent to the merchant’s web server.

2. From the server the data is passed to the payment gateway that stores it in the form of tokens, a specific type of secured storage.

3. The payment gateway relays this information to the payment processor, a third-party player that facilitates the transaction with a card network (Visa, Mastercard, American Express, etc.) and connects the merchant’s account with the payment gateway.

4. The customer’s bank either accepts or denies the authorization request depending upon successful verification, after which the bank sends a code to the payment processor containing information on the status of the transaction or error details.

5. The payment gateway then relays this information back to the website informing if the purchase was a success.

6. The customer receives a message with the transaction status i.e., was it accepted or denied via a payment interface.

7. The customer’s bank then transfers the funds to the merchant’s account instantaneous or within a few business days!

Phew! That was a lot.

An understandable confusion often arises where businesses want to know why they need both a payment processor and a payment gateway.

Don’t they do the same thing?

Turns out, not at all!

Payment Gateway vs Payment Processor

A payment gateway is a tool that communicates whether the transaction was approved or denied by connecting your merchant website with your payment processor. Whereas, the payment processor is responsible for facilitating the actual transaction with the bank. In this way, the former simply shuttles some sensitive data back and forth and the later actually moves funds from one account to another.

It’s true that a hardware POS-terminal in a brick-and mortar store may only need a payment processor, however, a virtual terminal which is any website on which a purchase is being requested needs the assistance of a payment gateway as well. Without the gateway your customer would have no clue about what went down after happened after they pressed the “Buy” button and be clueless about whether they actually bought something or not.

Sounds like an absurd experience no customer wants to have!

So, now that we know when and why we need it, let’s get into what qualities a top payment gateway platform should possess so you can make the best choice for your business!

What qualities do Best Payment Gateways have?

The best payment gateways will make transactions smoother with no hidden fees or charges while making multiple payment methods available. They must comply with the highest encryption standards to protect their customers’ highly sensitive payment-related data. Furthermore, chargeback prevention software can help payment gateways mitigate any risk of fraudulent activity.

Long gone are the days where lack of transparency and spamming emails can sell your product or service. Customer reviews and word-of-mouth matters! When trying to pick a payment gateway for your business look for recommendations. This can prevent you from making a poor choice for your business. A good payment gateway will always come highly established and well-recommended!

Now let’s do some myth busting shall we? Here are some common myths surrounding payment gateways:

1. The Fees are Similar to Mobile Banking Methods

Payment gateway fees are not like the service charges banks demand for offering mobile banking services. Banks do not offer the same platform or service! Gateways are just an interface for the e-services that banks offer for a better transaction experience.

2. Payment Gateways Hold Money

Payment gateways do not hold any money. They are simply in charge securing banking information of both parties and coordinating with the bank on their behalf. The gateways forward the transaction request and customer data to the bank which actually processes the payment. The payment gateways charges are only to facilitate this communication which is essential to web-based transactions!

3. Debit Card and Credit Card Transactions Cost the Same

Most payment gateways have different charges for debit and credit cards with most companies charging extra for credit card transaction due to higher risk factors. Of course, theft from a debit card is limited to the funds available in the account but theft from a credit card can put the card holder at risk of massive debt. Payment gateways ensure that this will never happen to your customer!

4. The Risk of Fraudulent Activity

It is true that the security provided by different gateways varies but this does not mean that secure gateways do not exist! If a business invests in a reliable service the risk of fraudulent activity is completely eliminated from your online transactions!

5. Same Services for Same Prices

Payment gateway charges depend upon the technology employed by the company to build its servers and create secure portals. One will not offer cheap services that do not come at cheaper costs. Furthermore, competitive pricing does not equate equal service. The merchant must look into the quality of the security and multi-payment options offered by the company.

The Value of Payment Gateways

Hopefully by now it’s clear that payment gateways for small businesses help foster growth by enabling secure transactions for online merchants! The transaction experience can be customized and made even more convenient for your clients by customized checkout pages. Integrating a versatile payment gateway into your current CRM or subscription management software is a way to improve client confidence and facilitate them by supporting multiple payment methods, while protecting clients from any risk of fraudulent activity or negative purchasing experience.