PayPal vs Braintree: Choose Your Ideal Processor

Do you buy or sell goods and services in cash, checks, and money orders?

While those traditional payment modes are in use today, especially by big enterprises and older age groups, such modes are gradually being dislodged by highly secured digital solutions offering unparalleled ease of use. This migration has been made easy with the existence of strong payment gateways that help secure online transactions.

If you are looking for a online payment processing system to manage your business online, chances are that you would evaluate two of the most famous options: PayPal vs Braintree. Each of these systems allows users to make secure and convenient payments, but still, there are a lot of differences between them. Today, we will compare PayPal vs Braintree in detail to guide you in making the right choice for your business.

PayPal: The Elevator Pitch

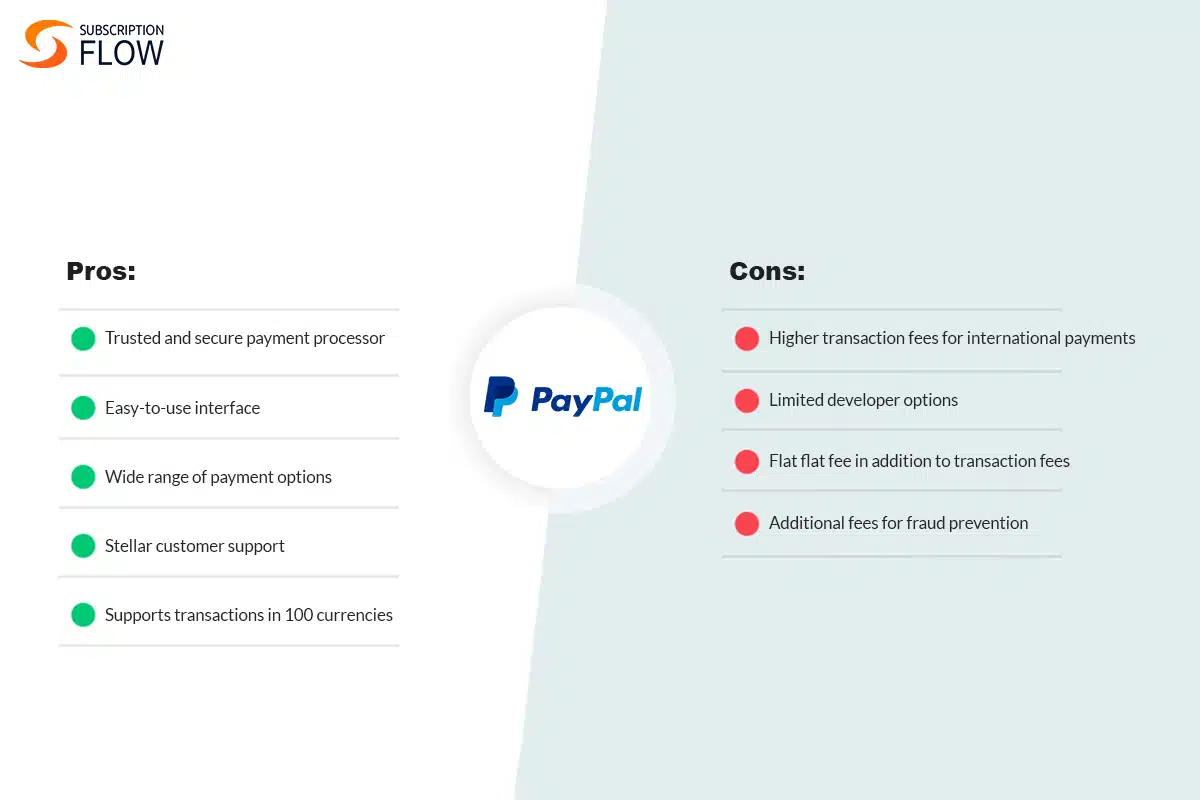

PayPal is regarded as one of the most popular payment processors in the market. It constitutes 60% of the total usage of payment gateways. It was founded in San Jose, California, in the year 1998. The company had expanded into 200+ markets at the end of 2022 and had 400 million active users using its services.

PayPal’s high level of security, extensive global reach, ability to integrate with numerous platforms, and wide range of payment options, including credit cards, debit cards, and PayPal balances, are the main reasons for its global popularity.

Braintree – The Elevator Pitch

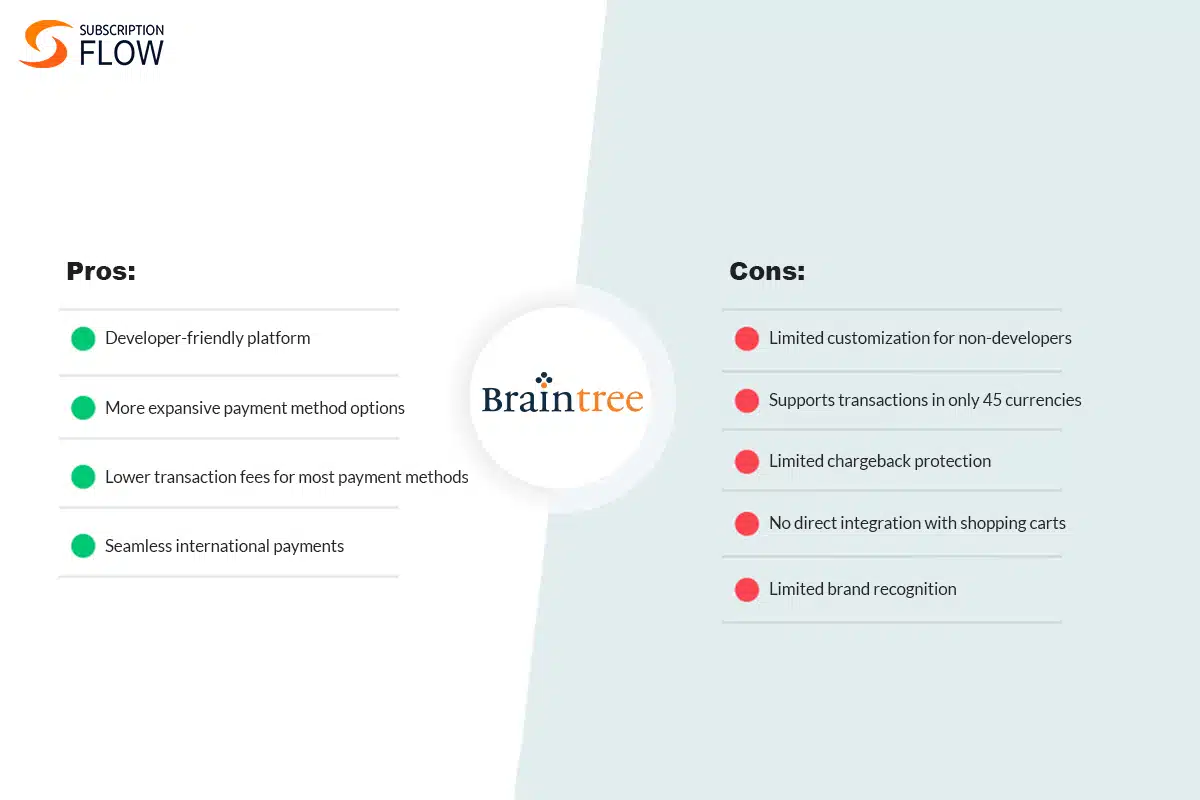

Braintree is another popular payment processor, acquired by PayPal in 2013. Braintree was founded in 2007 with its headquarters located in Chicago, Illinois. It gives its customers access to an array of different payment types, including credit/debit cards, digital wallets, and more. Braintree offers fraud protection capabilities akin to PayPal’s, and recurring billing is also supported by Braintree.

Another strong attribute of Braintree that developers appreciate is being relatively user-friendly with APIs and interfaces suitable for many different platforms, and programming languages. Braintree appears better suited for business solutions whereas PayPal caters equally for both businesses and persons.

PayPal vs. Braintree 2024 Comparison

Let us now take a closer look at the services provided by Braintree vs PayPal, as they are in 2024. Explore the major differences between these platforms.

1. User Interface (UI)

The users of PayPal and Braintree both benefit from interfaces which as simple and easy to use. That being said, Braintree is more developer-centric with an interface that is more focused on customizability and integration.

PayPal’s dashboard provides an overview of your account balance, recent transactions, and tools to manage your account, catering best to the needs of individuals and SMEs. Braintree’s UI is business-specific and they have a testing environment whereby payment processing solutions can be developed and then tested before going live.

2. Payment Methods

PayPal and Braintree both have payment systems through which one can process credit cards, debit cards up to $100 in transaction, PayPal balances, and bank transfers. Braintree, however, offers a more advanced payment processing platform and provides additional payment methods.

With PayPal Credit, customers can pay for their purchases over time with interest-free options. Other payment platforms popular among users are supported by PayPal, such as Venmo and PayPal Checkout. It ensures that the customers get a smooth payment experience.

Braintree supports a wider range of payment methods including credit/debit cards, PayPal, Apple Pay, Google Pay, Venmo, and Visa Checkout. Since Braintree’s platform is designed for businesses, it also allows merchants to add their own payment methods and offers more advanced features such as recurring billing and mobile payments.

3. Fees and Pricing

The pricing structures and other costs charged by PayPal and Braintree vary significantly. Let us examine them.

Payment Processing Fees:

PayPal and Braintree have adopted the standard industry practice of deducting 2.9% + $0.30 as a transaction fee per processed payment.

Both service providers offer discounts and other tailor-made pricing packages to non-profits and enterprise companies.

Fraud Prevention and Recurring Billing Fees:

Braintree equips users with robust fraud protection for free. It also provides them with a free trial.

PayPal’s fraud protection, and recurring billing feature costs users an extra 0.05% transaction fee. Other than that, PayPal has a fixed $10 fee charged to each user. These fees are separate from the users’ payment processing charges.

Chargeback Fees:

Braintree and PayPal have chargeback fees of $15 and $20 respectively for transactions within the US. PayPal’s chargeback fee varies depending on the origin country and currency being used.

Additional Fees:

With Braintree, you only pay for what you need. There is no fee for PayPal deposits, and only a 0.75% fee per transaction for ACH deposits. There is an additional 1% fee associated with non-US credit cards and non-US currencies.

PayPal offers free signup to individuals but charges a $30 monthly fee to business accounts. PayPal also charges a 3.5% transaction fee on American Express credit cards and a fixed 4.4% fee for non-US currencies that depends on the currency of choice.

Although the fees on transaction of both services offered by PayPal and Braintree are the same, the Braintree gives free fraud protection features free of charge and at a higher price in PayPal.

Comparatively, the fee structure for Braintree is more flexible and affordable.

4. Payment Security

PayPal and Braintree both focus on secure payment processing and protect the sensitive information of their customers. In addition, no matter which of the platforms is used, users benefit from strong fraud detection, and PCI-compliance.

Braintree, as a subsidiary of PayPal, benefits from PayPal’s robust security infrastructure and expertise. Both the payment gateways make use of a fraud monitoring system based on machine learning algorithms, which assesses real-time transactions, identifies fraud and blocks fraudulent transactions, and provide services related to encryption and tokenization for safe and secure data related to the customers.

Both Braintree and PayPal pay much importance to security. Both the gateways have applied similar measures of security in order to assure safe and secure processing. This makes them equals when it comes to this feature, although there may be subtle differences in their approaches.

5. International Payments

This way, PayPal and Braintree both offer international payments (in various currencies). But Braintree’s international payments are far smoother, without extra fees or currency conversion.

On the other hand, PayPal has hefty fees associated with international transactions and foreign currency. This would make it an expensive option for a business seeking to expand to other countries. Braintree has its drawbacks, but it obviously presents a much cheaper alternative when it comes to international payments. In this case, then, in terms of international transactions, Braintree wins!

6. Integrations and APIs

PayPal and Braintree both offer a range of integrations and APIs for popular Shopify, WooCommerce, and Magento. The difference is that, because it is a developer-friendly software, which is easy to use using APIs, Braintree has some popularity among businesses who require a lot of custom integrations.

7. Customer Support

PayPal and Braintree provide customer support via various channels. Phone calls, emails, and online chat etc. However, in several ways, there are slight differences between the two for the level of support given to customers and resources assigned to them.

PayPal gives the option of phone support to accounts (business or personal). Users can also access their help-center articles and online tutorials for FAQs. PayPal also has an active community forum is present. Another important fact is that it offers trustworthy support to the merchants dealing with high-volume transactions.

Braintree does also offer phone and email support, and a knowledge base filled with articles and guides meant to help merchants deal with recurrent problems. Moreover, they provide detailed documentations which acts as a step-by-step guide for those users who want to integrate Braintree with external software.

In general, both PayPal and Braintree provide customer support. While PayPal has a lot more extensive resources and is perhaps more dedicated to merchant support. Braintree’s support is more inclined toward assisting the developers with third-party integrations.

Conclusion

PayPal and Braintree are very reliable and secure payment processors. They offer a range of payment options and numerous convenient integrations. Which one of the two is better? You can better decide that based on your business’s size and requirements.

If you’re looking for an easy-to-use payment processor with a wide range of payment options, PayPal may be the better choice for you. On the other hand, if you’re looking for a developer-friendly platform with lower transaction fees and seamless international payments, Braintree may be the better option.