The Best Approach to Forecasting Subscription Revenue

Accurately forecasting subscription revenue is essential to fuel growth in your subscription business.

It enables proactive financial planning, helps your business navigate periods of increased economic uncertainty, and allows you to secure funding through lucrative B2B partnerships.

Unfortunately, effectively forecasting subscription revenue can prove to be a challenging task, particularly for businesses operating off a recurring revenue business model.

Subscription businesses must closely track the subscription lifecycle, account for any revenue leakage, factor in upgrades/downgrades, and monitor customer behaviour dynamically.

In this blog post, we will discuss how to forecast subscription revenue and cover the essential metrics you need to be tracking to this end. Let’s dive in!

What is Subscription Revenue Forecasting?

Subscription revenue forecasting simply means estimating the amount of revenue a subscription business is expected to generate over a specific period e.g., a month, a quarter, or a year.

Most businesses track all three to get a more complete picture of their business’s revenue-generating performance.

Sounds fairly straightforward, but it can get quite complicated to do it right.

More technically, forecasting subscription revenue refers to the complex process of predicting the future earnings of a subscription business, through the analysis of historic data, monitoring of market trends, and tracking of important KPIs to make informed projections about future revenue streams.

The goal is to make accurate predictions about cash inflow to allocate resources effectively, mitigate risks, identify growth opportunities, secure funding, and ultimately grow the bottom line.

Key Metrics to Track for Accurate Revenue Forecasting

Many businesses make the mistake of tracking too many irrelevant metrics and getting lost in a massive data pool that doesn’t paint a very clear picture of your future earnings.

This is why we’ll start by giving you a list of relevant metrics to track and how to calculate them for an accurate forecast.

1. Monthly Recurring Revenue, MRR

MRR is a core and straightforward metric that tracks incoming cash flow for every month.

To calculate your MRR, simply multiply the number of active subscribers by the average revenue per account (ARPA).

For example, if your ARPA is $100 and you have 50 active users, your MRR will be $5000.

As this metric represents a short interval with relatively less dramatic fluctuations it can be a good way to quickly assess revenue generation.

2. Annual Recurring Revenue, ARR

Logically speaking, multiplying your MRR by 12 will give you a rough yearly forecast of your earnings.

In the previous example, a $5000 MRR translates into a $60,000 ARR.

However, a word of caution: fluctuations in other metrics and changing market trends during this much longer time scale result in a large margin for error associated with this projection.

Other metrics must also be accounted for, to finetune this number.

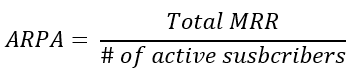

3. Average Revenue Per Account, ARPA

To get a macro sense of your earnings, you must zoom into the micro-scale and calculate an average value against each account.

To calculate the average revenue generation at the customer level your MRR is divided by the # of active subscribers by tweaking the MRR formula.

An important note: here your total MRR will come from historic (real) and not projected data as you can only solve an equation for one variable at a time.

To illustrate, if your accounting department reports that your subscription services yielded $12,000 this month from 60 subscribers, your ARPA will be $200.

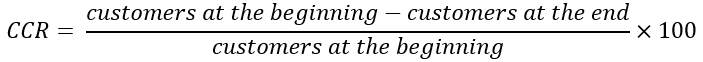

4. Customer Churn Rate, CRR

CCR is one of the most important metrics to track for accurate financial forecasting. It is also fairly uncomplicated to calculate over a set period, using the following equation,

CRR represents what fraction of customers you started at the beginning of a period, were lost at the end of that period.

If your business had 100 customers on the 1st of April and had only 63 left by the 1st of May, then your monthly churn rate for that month is 37%.

You might ask: Is that too much churn or a record-breaking low amount?

Context is important when interpreting your KPIs.

For example, a high churn rate may not be a cause for concern if it is within industry norms or if the business has a strategy to acquire new customers at a faster rate.

Tracking churn and interpreting it contextually, starts a productive conversation to strategize growth may it be by pushing for more customer acquisition or prioritizing retention and increasing customer lifetime value (LTV).

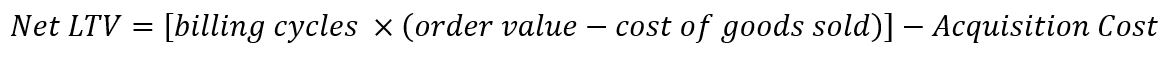

5. Customer Lifetime Value, LTV

An often-overlooked metric is the LTV of your customers. Customer LTV is the amount of revenue that you can expect to generate from a customer during their lifespan with your business.

Tracking retention rates post signup and monthly churn rates are important to calculate LTV whose tracking is surprisingly effective in unlocking growth, as discovered in the benchmarking study by Darryl Hicks and Karen Webster, two CEOs in the payments space.

They found that only 58% of the companies under study were tracking this key metric and there was a correlation between tracking the LTV KPI and the company’s revenue generation capabilities.

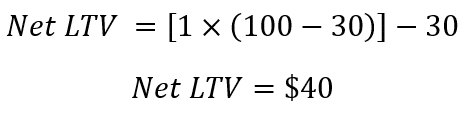

They also found an inconsistency in the way this key metric was being calculated and proposed the following standard formula,

To illustrate if your customer has been around for one billing cycle, you sell them subscriptions worth $100, with a $30 cost price, and your marketing department spent roughly $30 in acquiring this new customer, their LTV will be calculated as follows,

This value becomes more interesting in the case of B2B SaaS contracts where clients commit to stick around for a certain number of years.

How to Forecast Subscription Revenue?

You can forecast your subscription revenue automatically by utilizing SubscriptionFlow’s revenue management software, which dynamically tracks all relevant KPIs on your behalf and displays them neatly on a customizable and user-friendly dashboard.

The all-purpose subscription management engine tracks customer data closely and uses historic data to predict churn, acquisition, and retention rates. In doing so it can accurately forecast your revenue without any manual hassles or errors.

Forecasting Subscription Revenue Accurately – Important Considerations

To ensure accuracy, pay close attention to the following steps during your forecasting procedure.

1. Closely Monitoring your Customer Base

In any given period, revenue flows into your business through your existing subscribers, new subscribers, and future subscription renewals.

Your customer base in a certain period consists of active subscribers during that period plus any new customers who join in that period minus subscription cancellations.

This figure keeps fluctuating and needs to be routinely tracked.

The MRR can then be calculated by multiplying your active customer base with the ARPA metric for a real picture of your monthly earnings.

2. Accounting for Churn

The importance of tracking and deflecting churn cannot be overstated.

As Darryl Hicks in the Subscription Show 2022, simply puts it,

“What gets measured, gets managed.”

If you fail to properly account for the CCR metric, you will consistently overestimate your earnings and fail to allocate the right budget to different business operations sabotaging growth.

3. Factor in Change

Relying solely on historical data to forecast future revenue generation may prove insufficient for accurate revenue forecasting.

The reason?

Several variables such as the launch of new products or services, cross-bundling, alterations in pricing, fresh marketing campaigns, sales promotion strategies, seasonal fluctuations, and economic downturns all significantly influence your projected revenue.

To make a more accurate revenue forecast, it is essential to analyze the changing trends in consumer behavior, monitor the success of new business strategies, and use sales projection reports. This approach will enable you to fill in the gaps and create a well-rounded projection.

Through robust growth and retention management software such as SubscriptionFlow, you can monitor usage patterns, improve product usage through targeted messaging and offer personalized incentives to groups at risk of churn.

Keeping the aforementioned complexities in mind your MRR forecast should be an accurate representation of your earnings and can be multiplied by any number of months to get a quarterly (QRR) or annual (ARR) recurring revenue forecast.

Final Remarks

In conclusion, your subscription business can accurately forecast subscription revenue by tracking key performance indicators such as MRR, ARR, ARPA, CCR, and LTV.

Revenue management software, SubscriptionFlow, offers unparalleled convenience and ensures forecasting accuracy through automation.

During manual forecasting, businesses must pay close attention to the important considerations of working with the right customer base and supplementing historic data with cohort analysis and changing market trends.

Such robust and well-rounded revenue forecasting can help businesses make informed financial decisions and unlock long-term growth.