Stripe vs Shopify: Which Payment Processing Platform is Right for Your Business?

Comparing Stripe vs Shopify as holistic platforms is a lot like comparing apples to oranges.

After all, Stripe is designed to be integrated into websites and other software, exclusively to power payments, whereas Shopify is a standalone eCommerce platform that offers many features in addition to integrated payment solutions for online stores.

In this blog, we will more specifically compare Stripe vs Shopify Payments, in terms of their payment related features, pricing, and best use cases, etc. Choosing the right payment processing platform is one of the most important decisions you will make as a business owner and is critical to unlocking your true revenue growth potential.

Through this in-depth analysis, you should have a better understanding of which platform is the best fit for your business’s payment related needs.

What is Stripe?

Stripe is an industry leading payment gateway and processor that allows businesses to accept online payments. It was founded in 2010 and has quickly become one of the most popular payment processing platforms.

Stripe allows businesses to accept payments from customers all over the world and supports over 135 different currencies. In 2023, Stripe enjoys a market share of 19.44%, second only to PayPal in the payment processing category.

What is Shopify?

Shopify is an eCommerce platform that allows businesses to create an online store and sell their products. It was founded in 2004 and has since become one of the most popular eCommerce platforms in the world. Shopify allows businesses to manage their online store, track inventory, process orders, and accept payments.

Shopify Pay Installments has a market share of 12.42% in the payment processing market and falls in the top 5 payment solution providers in the market.

Stripe vs Shopify: Features and Functionality

Both Stripe and Shopify Pay offer a wide range of features and functionality to their users. However, there are some key differences between the two platforms.

Stripe offers a powerful payment processing system that is designed to be easy to use. It offers a wide range of payment options, including credit cards, debit cards, and digital wallets. Stripe also supports recurring payments and subscription billing. One of the key advantages of Stripe is its API, which allows businesses to customize their payment processing system to meet their specific needs.

Shopify, on the other hand, is an all-in-one eCommerce platform that includes payment processing as one of its features. Shopify offers a wide range of features, including website hosting, inventory management, and marketing tools. Shopify also offers a range of payment options, including credit cards, debit cards, and digital wallets. One of the key advantages of Shopify is its ease of use, as it is designed to be user-friendly for beginners.

Stripe vs Shopify: Pricing

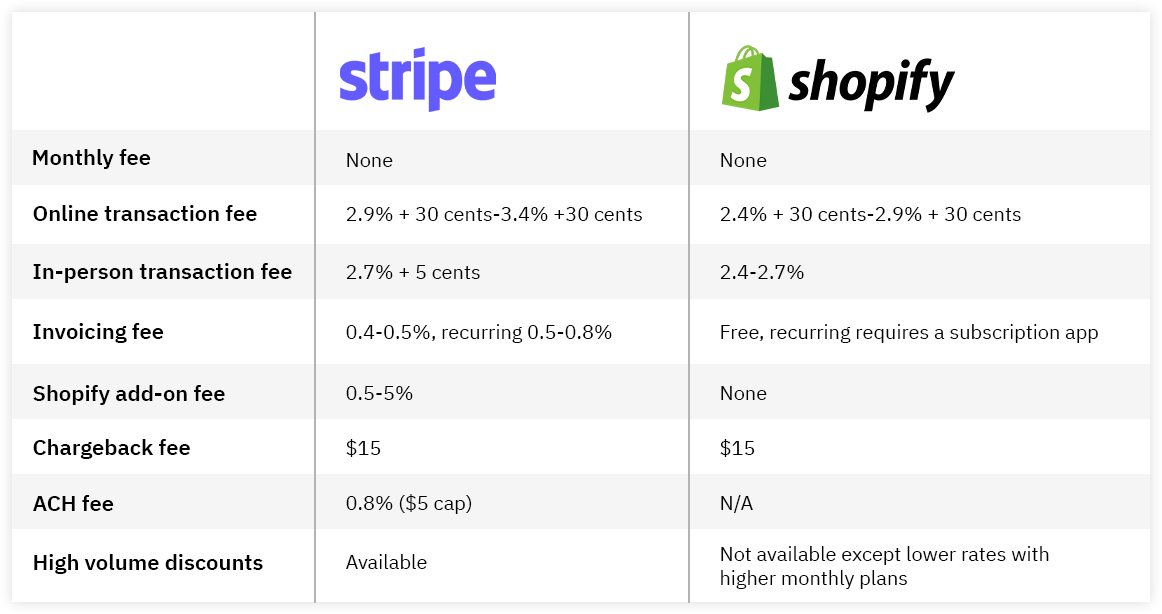

When it comes to pricing, both Stripe and Shopify offer transparent pricing models with no hidden fees.

Stripe charges a flat rate of 2.9% + 30 cents per transaction which is an industry standard. This rate applies to all transactions regardless of the payment method or currency used. Stripe also offers volume discounts for businesses with high transaction volumes.

Shopify charges a percentage fee for each transaction, which varies depending on the pricing plan that you choose. The fees range from 2.4% + 30 cents per transaction to 2.9% + 30 cents per transaction. Shopify also offers additional payment options, such as Shopify Payments, which can reduce the fees for some transactions.

Stripe: Pros and Cons

Despite its immense popularity, Stripe, like any other payment processing platform, comes with its own set of pros and cons.

Here are some of the major advantages and disadvantages of using Stripe for payment processing:

Pros

1. Easy Integration

One of the biggest advantages of using Stripe is its ease of integration into websites and mobile applications. It offers a wide range of APIs that allow developers to easily integrate payment processing functionality into existing software.

2. Flexible Payment Options

Stripe supports a variety of payment options including credit cards, debit cards, digital wallets like Apple Pay, Google Pay, and more. It also allows businesses to accept payments from customers all over the world in over 135 different currencies.

3. Highly Secure

Stripe is PCI compliant which means that it follows strict data security standards to ensure that customer information is safe from fraud.

4. Recurring Payments

Stripe supports subscription billing models which makes it easy for businesses to collect recurring payments from customers on a monthly or yearly basis without requiring them to manually authorize every transaction.

Cons

1. Transaction Fees

While Stripe’s transaction fees are transparent with no hidden charges, they can add up quickly, especially for businesses with high transaction volumes.

2. Limited Dispute Resolution

Unlike PayPal, Stripe does not offer any built-in dispute resolution mechanism which means that businesses must handle disputes manually which can be time-consuming and costly.

3. Account Freezes

There have been instances where businesses’ accounts have been frozen by Stripe due to suspected fraudulent activity or violation of terms of service which can cause significant disruptions in cash flow and payouts.

Shopify Payments: Pros and Cons

While Shopify Payments offers many benefits, it also has its own set of pros and cons.

Pros

1. Easy Integration

One of the biggest advantages of using Shopify Payments is its seamless integration with the Shopify platform.

This means that businesses can easily manage their online store, track inventory, process orders, and accept payments all in one place. This makes it perfect for eCommerce and retail stores.

2. Transparent Pricing

Similar to Stripe, Shopify Payments offers transparent pricing with no hidden fees. The transaction fees range from 2.4% + 30 cents per transaction to 2.9% + 30 cents per transaction depending on the pricing plan you choose.

3. Multiple Payment Options

Shopify Payments also supports a wide range of payment options including credit cards, debit cards, digital wallets like Apple Pay and Google Pay, as well as alternative payment methods like Amazon Pay and PayPal Express Checkout.

4. Fraud Protection

Shopify Payments comes with built-in fraud protection features that help protect businesses from chargebacks and fraudulent transactions.

5. 24/7 Support

Shopify offers round-the-clock support to its users via phone, email or live chat.

Cons

1. Restricted Use in Certain Countries

While Stripe supports over 135 different currencies and allows businesses to accept payments from customers all over the world, Shopify Payments is currently only available in select countries including the US, Canada, UK, Australia, New Zealand, Singapore, and Japan.

2. Limited Customization Options

Unlike Stripe which offers a wide range of APIs for developers to customize their payment processing system according to their specific needs, Shopify Payments has limited customization options.

3. Chargeback Fees

Although Shopify Payments provides fraud protection features to businesses, it charges a fee for every chargeback dispute regardless of whether the business wins or loses the dispute.

Shopify Payments is a great option for businesses that are looking for an all-in-one eCommerce platform with built-in payment processing features. Its ease of use, transparent pricing, and fraud protection features make it an attractive choice for many businesses. However, its limited customization options and restricted availability in certain countries may not be suitable for all businesses.

Conclusion

Choosing between Stripe and Shopify ultimately comes down to the needs of your business. If you are primarily focused on payment processing and need a customizable payment processing system, Stripe may be the best choice for you.

On the other hand, if you are looking for an all-in-one eCommerce platform that includes payment processing as one of its features, and is user-friendly for beginners, then Shopify may be the better choice. Ultimately, businesses should carefully evaluate their payment processing needs and consider the pros and cons before deciding whether Stripe or Shopify is the right choice for them.