What is Account Reconciliation And Why is it so Important?

At the end of every fiscal year, accountants and finance managers emerge in full glory. It’s the time of the year when any and every transaction made throughout the year is accounted for. Financial statements are prepared, audits are done, and the revenue cycle is measured and checked with keen observation. It would be good to say, it is the most important time for any business.

Account Reconciliation does just that!

Reconciliation is the process of comparing internal financial records against monthly statements from external sources—such as a bank, credit card company, or other financial institution—to make sure they represent the true aspect of financial position. Knowing how to reconcile your accounts accurately is essential for the financial health of your business, as it helps to detect any errors, discrepancies, or fraud.

What is Account Reconciliation?

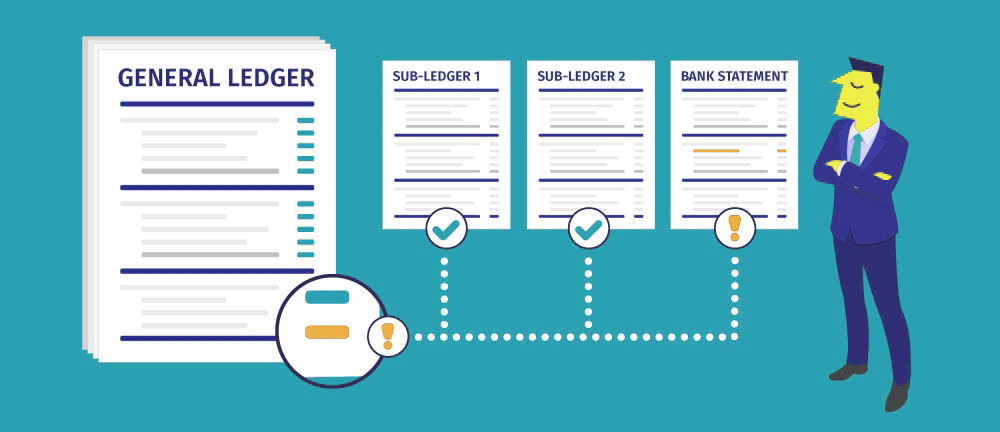

Account reconciliations are performed by accountants at the end of each fiscal year. These reconciliations are done to ensure the accuracy and completion of the general ledger account balance.

Usually, the general ledger account balance is compared to third-party data, independent systems, and other documentation to support and balance the finances stated in the ledger.

For Example,

If you run a small-scale business, you might be keeping a point-of-sale ledger, or similar software, that records your balances, daily transactions, and inventory. The external bank account also keeps track of all the deposits, purchases, transactions, and long-term balances.

Public companies are compelled to keep consistent reconciled accounts or there is a high risk of being penalized by independent auditors. Most companies have systems in place for maintaining all receipts, statements, and data necessary to support and document account reconciliations.

Why is Account Reconciliation Important?

To ensure that financial statements are complete and accurate, account reconciliation is an important step. Companies specifically must reconcile to eliminate any significant or small misstatement.

SOX Section 404 (Sarbanes-Oxley Act Section 404) mandates that all publicly-traded companies must establish internal controls and procedures for financial reporting and must document, test, and maintain those controls and procedures to ensure their effectiveness.

If the reconciliation process is not completed on time, it introduces a risk to the end of the fiscal year. An automated approach to reconciliation reduces the risk of misstatement.

The first step in an organization’s financial close process is account reconciliation which gives the finance team the confidence that their information is authentic, reliable, and clear. It also allows them to see any misstatement or discrepancy that may have occurred.

Internal Controls for Reconciliation

Internal controls are set up within the finance team to highlight all reconciliation-related issues. It also helps to identify fraud, clerical errors, and any other hiccup that may put a pause to the closing process.

Setting up internal controls is one of the first things a company or department does. This is also done to prevent fraud and ensure the integrity of the finances and revenue.

For consistent financial statements, it is necessary to put controls in place that will help mitigate some of the risks. Internal controls grow with the organization. Internal controls include:

- Detective controls – controls to highlight the problems with the accounting processes.

- Preventative controls – controls put into place to help clerical accuracy and prevent employee fraud.

- Corrective controls – controls put in place to correct errors found by detective controls.

How to Perform Account Reconciliation?

When you use account reconciliation software to reconcile accounts, most of the work is done by the software itself. But human involvement is still required for entries or transactions that might have never reached the system (for instance petty cash theft).

Here is a step-by-step guide on how to do account reconciliation and make sure all the money is accounted for:

Record Comparison

The first and foremost step of reconciliation preparation is to compare the bank statement with the internal account register. Each payment, deposit, and transaction is cross-checked and ticked off the list. Every single penny needs to match the statement that you have.

If you don’t have a receipt, make a note of all the transactions on the bank statement.

Outgoing Funds: ✔

Both internal records and bank accounts need to reflect the same outgoing funds, no matter the type of transaction (cheques, ATM transactions, online payments, or any other charges). All of these transactions need to be subtracted from the bank statement balance. If there are any charges that you haven’t seen in the internal records, make a note of them.

You need to keep a lookout for any uncleared cheques, uncleared payments, ATM service charges, NSF (insufficient funds, over-limit fees, or overdrafts.

Incoming Funds: ✔

You need to check that both internal records and bank accounts reflect all incoming funds. You need to manually add all the deposits and account credits in the statement balance that haven’t yet been recorded by the bank.

If there is deposited money in the bank not showing in the books, make the entry. If you have any interest-bearing account statements that haven’t been added, you need to add them in the books as well.

Bank Errors: ✔

It is not often that bank errors occur but if they do, the exact amount needs to be subtracted or added to the account balance and the bank needs to be contacted immediately to report the error.

Accurate Balance: ✔

After all this, the bank statement should now equal the recorded balance in your internal books. If the number of discrepancies is significant, a supporting schedule needs to be created to record the details between the internal books and the bank accounts.

You need to procure bank statements on every monthly closing to balance the sheets. The closing balance is confirmed by the bank and then and only then can the reconciliation happen.

Reconciliation: Discrepancies, Challenges, and Causes

Even though technology has evolved, many companies still prefer to manually manage the reconciliation process and maintain spreadsheets (which are highly intricate and complex).

This causes the finance team to be buried under a mountain of bank statements and spreadsheets, thus missing deadlines and increasing the chance of double-entry and/or human error. The most common problems associated with a manual reconciliation process are:

- Low visibility and transparency

- Lack of controls and efficiency

- High risk, cost, and time

Even small errors, in the beginning, can grow to become the equivalent of a financial tumor as the financial close continues.

All discrepancies are identified in the reconciliation process. They may be caused by multiple factors including:

- Differences in Timing

Timing is everything when it comes to capturing data. There might be an instance where a certain entry is present in the general ledger but it is absent or not yet captured in the supporting data or documentation and vice versa.

For instance, while performing a cash account reconciliation, you mate note the general ledger shows a balance of $250,000, but the bank statement shows an account balance of $270,000. Upon further investigation, it is revealed that a $20,000 cheque is yet to be cleared by the bank. As such, the timing difference due to an outstanding cheque can put a pause to the reconciliation process.

- Missing Transactions

There might be instances, where entries are present in the general ledger but not in the supporting documentation or data and vice versa. For example, the credit card processing statement shows a balance of $150,000 but the ledger balance is $120,000.

Upon investigation, it is revealed that three transactions were improperly excluded from the general ledger. Hence, the discrepancy.

- Mistake or Error

A mistake or error might occur that may suggest a discrepancy between the supporting data/documentation and the general ledger. For instance, a cash account reconciliation shows the bank statement to be $150,900 but the general ledger shows a balance of $150,000. Upon investigation, it is revealed, that the company recorded the bank fees of $1000 rather than the original $100. So, a $900 error should be noted and a journal entry should be recorded.

Account Reconciliation Software

Account reconciliation software produces high-quality and accurate financial statements. It automates and standardizes the reconciliation process. It drives accuracy in the financial close by providing accountants with a streamlined method to verify the correctness and appropriateness of their balance sheets.

It is a quick and effective way to compare general ledger, bank, and financial statements, investigate discrepancies, verify supporting documentation and take required actions. This removes the tedious task of manually reconciling everything and lets the accountants focus on analyzing discrepancies.

Features of account reconciliation software include:

- Reconciliation templates

- Checklists to standardize processes

- Automated review and approval workflows

- Easy review and audit

- Integrated storage of supporting documentation

- Links to applicable policies

Audit Benefits of Account Reconciliation Software

Automating reconciliations has significant benefits including;

Speed of financial close

Automation lets you close much faster than organizations that rely on manual work. With automation, any firm can close in a short time frame. According to statistics, more than 80% of companies can do monthly within four to six business days with reconciliation software.

Standardization

Since reconciliation software standardizes the entire reconciliation process, companies can run their month-end and quarter-end with automation. This means you’ll be able to close faster and your team will be able to focus on other tasks.

Human Error Reduction

Human error leads to unavoidable mistakes which lead to wasted time. With automation, this process is streamlined and manual entries and human errors will be avoided.

Reconciling accounts and comparing transactions also helps your accountant produce reliable, accurate, and high-quality financial statements. Because your company balance sheet reflects all money spent—whether cash, credit, or loans—and all assets purchased with those funds, the accuracy of the balance sheet strongly depends on the accurate reconciliation of your company’s financial accounts.

How Subscription Flow Will Help You With Account Reconciliation?

Subscription Flow will help you with automation. You will be able to take control of your financial reporting while still having time to focus on your company’s growth and scaling your business.

Payment Reconciliation will allow you to reconcile payment gateway statements with your accounting system, with just a click. SubscriptionFlow will minimize the time you put into manual reconciliation and sync with your accounting solution and take charge of handling refunds, adjustments, coupons, promotions, etc.

You’ll also be able to monthly-close faster than ever before. You’ll also be able to forecast the cash flow more efficiently and accurately.

Furthermore, if you get an accounting integration such as Xero, Avalara, or QuickBooks, you’ll be able to handle your reconciliation breezily. Automatic reconciliation is a time-saver and allows you to sync perfectly your books with the accounting software.