Freshbooks vs QuickBooks vs Xero: A Comparison

Integrating the correct accounting software to your subscription management system allows your business, regardless of size, to efficiently manage finances to boost revenue growth. However, the sheer abundance of SaaS business solutions from all across the market can make it challenging to pick the right accounting software to integrate.

We’re here to help.

FreshBooks, QuickBooks, and Xero are all powerful accounting software with unique strengths that can be integrated with your subscription management platform to streamline and assist accounting processes.

This blog provides a comprehensive comparison of FreshBooks vs QuickBooks vs Xero, three highly popular accounting software. We will discuss their essential features, pricing models and focus on the pros and cons of each solution. Whether you are a freelancer, small-sized business owner, or medium-sized enterprise, knowing what is different between FreshBooks, QuickBooks, and Xero will help you decide which accounting software will best meet your requirements.

Freshbooks vs QuickBooks vs Xero: Introduction

Freshbooks, QuickBooks, and Xero are all cloud-based accounting software designed for small to medium-sized businesses to streamline their financial management. Many core features such as invoicing, expense tracking, bank reconciliation, general ledger, tax preparation, and revenue reporting are offered by all three options.

However, each of these software also possesses unique features and functionalities that set them apart from the others. They also differ in pricing structures and customer acquisition strategies among many other factors.

QuickBooks vs FreshBooks vs Xero: Features Comparison

1. Expense Tracking

In terms of expense tracking, you can easily record and categorize expenses, import bank transactions, and reconcile accounts using any of the three.

Expenses can be manually entered or imported from bank transactions and credit card statements for automatic expense recognition. Receipt snapshots and emails can be sent to your account for tax preparation.

Important to note:

- QuickBooks and Xero both allow the categorization of expenses into various accounts, assisting the analysis of complex spending patterns.

- FreshBooks does not offer advanced features to handle complex expense tracking scenarios.

2. Inventory Management

Businesses that need to keep track of inventory, track stock levels, and generate purchase orders when inventory needs to be replenished have much to gain from robust inventory software.

- FreshBooks does not provide such inventory management features.

- QuickBooks and Xero both offer advanced inventory management features.

These features allow you to monitor the quantity and value of your inventory and make informed decisions about purchasing, pricing, and sales.

QuickBooks also supports features like barcode scanning, serial number tracking, and customizable inventory reports for better inventory control and analysis. Xero offers the most robust inventory management capabilities that also include inventory adjustments for damaged goods and detailed reporting among many other features.

3. Payroll Management

Payroll management services are vital to businesses that want to pay their employees on time and automate taxation requirements.

- FreshBooks does not offer this feature.

- QuickBooks and Xero both offer payroll management.

This includes payroll calculation, pay slip generation, tax filing, leave management, employee self-service portals, and direct deposits.

4. Time Tracking

Important for service-based businesses, FreshBooks ensures you lose no billable time through dynamic time-tracking and generates invoices based on the logged time. Both Xero and QuickBooks also offer this functionality.

5. Taxation Support

FreshBooks offers basic tax-calculating capabilities. It allows you to set up tax rates based on your business location and apply them to your invoices. FreshBooks automatically calculates the tax amount based on the tax rate and applies it to the total invoice amount. However, it does not provide advanced tax features or extensive tax reporting options compared to QuickBooks or Xero.

QuickBooks is known for its comprehensive tax-calculating capabilities. It supports various tax types, including sales tax, payroll tax, and other tax obligations specific to different regions. QuickBooks allows you to set up tax rates and tax agencies, automatically calculates the tax amounts on invoices, and tracks tax payments and liabilities. It also provides detailed tax reports, making it easier to file tax returns and stay compliant.

Xero offers robust tax calculating features to meet the tax requirements of different regions. It supports various tax types, such as sales tax, VAT, and GST, allowing you to set up tax rates specific to your business needs. Xero automatically calculates taxes on invoices based on the configured rates and provides detailed tax reports. It also integrates with tax filing services in some regions, simplifying the process of submitting tax returns.

Both QuickBooks and Xero provide more comprehensive tax calculating capabilities compared to FreshBooks. They offer greater flexibility in managing different tax types and provide more advanced tax reporting features. QuickBooks and Xero also offer integration options with tax filing services, which can streamline the tax filing process for businesses.

6. Team Collaboration

FreshBooks also provides basic project management capabilities: you can set up and manage projects, track the time spent on each task, and allocate projects to team members. Nonetheless, in terms of project management, it is relatively less feature-rich compared to dedicated project management tools.

Some project management is integrated into QuickBooks: you can set up a project and assign team members, track income and expenses coming in or going out of the business, and even integrate third-party project management tools like TSheets.

Xero offers comparatively more robust project management and team collaboration features. Xero’s project management capabilities include features like budgeting, project-specific reporting, and profitability analysis.

However, it’s important to note that these project management features may be considered a plus point but are limited compared to those offered by dedicated project management software.

QuickBooks vs FreshBooks vs Xero: Pricing Structure

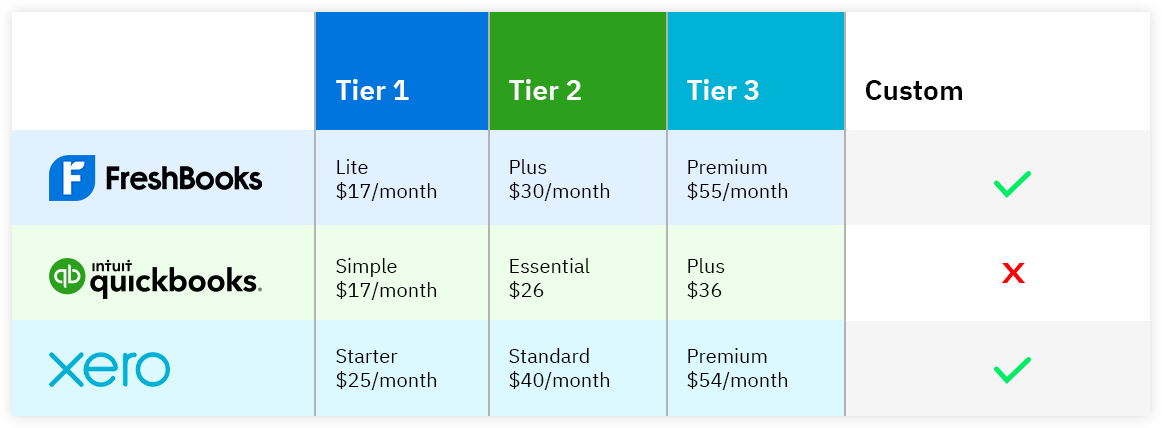

All three software offer tiered pricing plans summarized in the following infographic.

- FreshBooks offers three pricing tiers: Lite ($17/month), Plus ($30/month), and Premium ($55/month). Each tier varies in the number of billable clients and features included. It also offers custom pricing.

- QuickBooks offers three tiers as well: Simple Start ($17/month), Essentials ($26/month), and Plus ($36/month) depending on the features required.

- Xero offers three pricing plans: Starter ($25/month), Standard ($40/month), and Premium ($54/month). The pricing varies based on the number of invoices, bills, and employees you have.

FreshBooks vs QuickBooks vs Xero: Other Factors

1. Customer Acquisition Strategy

Each of the three software offers a 30-day free trial that can be canceled at any time.

- FreshBooks has the added advantage of offering a card-less 30-day trial

- FreshBooks also offers 50% off for 6 months to incentivize small businesses and self-employed customers to avail of their services

- QuickBooks offers a $1/month subscription for each plan for the first 6 months of use offering unprecedented convenience to customers.

2. Mobile App

All three offer mobile applications to track finances on the go but the functionality of each app varies with the software. To illustrate the QuickBooks app supports payroll management, unlike the FreshBooks application. The Xero app also has greater project management capabilities.

3. Customer Support

FreshBooks, QuickBooks, and Xero do differ in their customer support offerings.

FreshBooks provides customer support primarily through online channels. These include:

- Help center

- Email support

- Community forum

- Phone support only during business hours for customers on higher-tier plans

QuickBooks offers multiple customer support channels to assist users. These include:

- Help center

- Phone support

- Live chat

- Community forum

Xero provides customer support through a combination of online resources and direct contact options. These include:

- Help center

- Email support

- Community forum

- Phone support during business hours for customers on higher-tier plans.

When it comes to customer support, QuickBooks and Xero offer a wider range of options, including live chat and dedicated phone support. FreshBooks offers customer support via email or other online tools. It does offer phone support for higher-tier plans.

Important to note:

The type of customer support you can get depends upon your subscription plan, location, as well as the version of software you use.

Xero vs QuickBooks vs FreshBooks: Conclusion

FreshBooks is a great integration for those service-based businesses where close-time tracking is necessary. QuickBooks is stronger at payroll management and also has more robust inventory features. The Xero integration stands out given its features in better inventory management, so it is best suited for business that rely majorly on inventory.

When choosing an accounting software to assist subscription management, think about the specific needs of your business, your budget, and how a particular feature would optimize your performance. After all, selecting the best accounting platform to enhance the functionality, and productivity of your subscription management software makes your business take a leap.